You will remember in my first article post the onset of the Covid-19 pandemic key indicators we, at FIIG, use to price where issuers of corporate bonds might access the domestic bond market. Without defining each of the key benchmarks given this was done in my previous article, we have seen a turnaround in these benchmarks where it can be concluded it is becoming cheaper and more possible for issuers to issue. That said, it is only issuers with sound business models and strong credit metrics and well-structured issues that have access in the immediate term.

So, where are these indices at?

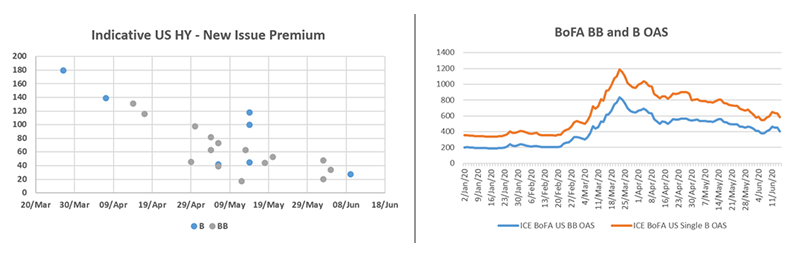

- US new issue premia, US Option Adjusted Spreads (OAS):

New issue premia and OAS are indicative of the credit margin at which issuers have issued over and above where secondary market trades are taking place in that issuer’s bonds. OAS are traded credit margins of corporate issuers in the secondary market. Given the dearth of high yield bonds in Australia, we are using the US market as a proxy. You can see a significant trend downwards.

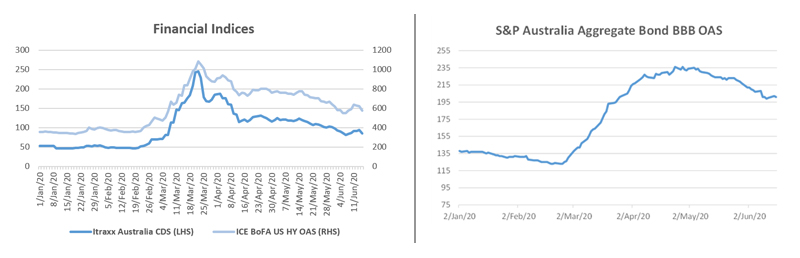

- Bringing the analysis back to Australia, we look at the Australian iTraxx, an indice of credit margins of a basket of investment grade corporate bond issuers. The iTraxx in January was about 50 bps, kicked up to 250bps mid-March, and has now gently declined to 85 bps. Another useful indices is the Standard & Poor’s Australia Aggregate Bond BBB OAS.

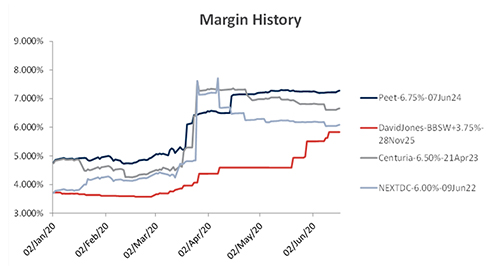

- For specific unrated bond issues in the Australian bond market, we reference the margin history of issues not originated by FIIG:

The last piece of the puzzle is attitude and demand from investors. Over the last two weeks we have seen a demonstrable change in investor sentiment from disbelief at the start of Covid-19 to acceptance in May and now to having reconciled where their investments have gone and what they need to do in the future. There is cash out there needing a home.

Conclusion: the above are all going in the right direction for issuers.

Open an account with FIIG in less than 5 minutes

About FIIG Debt Capital Markets

The Debt Capital Markets team assists both rated and unrated corporates & Financial Institutions (FI) in securing long-term and flexible bond financing in the Australian market. FIIG is a leader in the Australian unrated debt capital market, establishing our service with an unrated bond offering in 2012 unique to the domestic market.

FIIG typically arranges and distributes bonds via Australia’s over-the-counter (OTC) domestic bond market where there is no need for a prospectus. Bonds are distributed to over 5,000 wholesale investors that trade bonds with FIIG.

FIIG acts as a Sole or Joint Lead Arranger and has significant primary placement capabilities as a co-arranger. FIIG has raised more than $2.8bn in both the rated and unrated market.

FIIG can assist Corporate & FI Borrowers in the following areas:

- FIIG Private Debt placement service as part of a structured financing solution in deal sizes of $10m+; or

- FIIG Debt Capital Markets via our $25m+ unrated bond arranging service.

Please get in touch to discuss