Over the past three weeks we have introduced the Core Income, Income Plus and Inflation-Linked options. This week, we profile the Customised portfolio option

The Customised Investment Program

The Customised Investment Program allows the investor to tailor their fixed income portfolio to fit their investment goals. Investors can opt for this option with a minimum investment of $5 million.

The MIPS team has a range of investment criteria that can be adjusted as per the client’s instruction. The client can ‘dial up’ or ‘dial down’ these criteria based on their objectives and their risk appetite.

The criteria include*:

- Liquidity – Amount of Cash, Cash Equivalents, Government and Semi-government Securities

- Credit – Mixture of Investment Grade, Sub-Investment Grade and Unrated Securities

- Capital Structure – Mixture of Senior Debt and Mezzanine / Subordinated Debt (with a potential to support other lower ranked securities)

- ESG – Ethical, Social and Governance overlays to the portfolio

- Duration – Degree of modified duration

- Portfolio diversification – Minimum number of bonds, issuer and issue concentration metrics

- FIIG Arranged Bonds – Level of exposure to FIIG arranged securities

*Please see the information memorandum for more details.

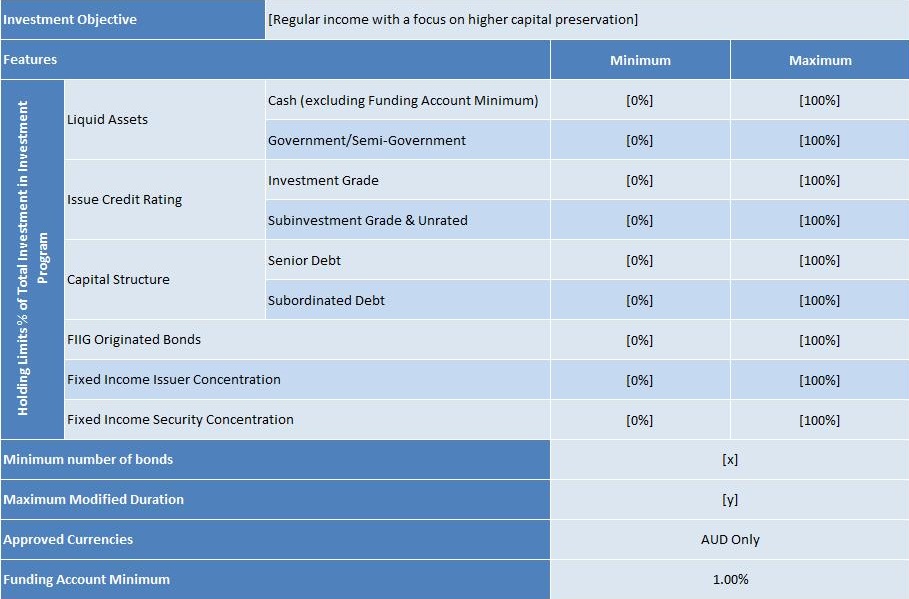

Figure 1 below is a template that investors can use to construct their customised portfolio. All of the minimum allocations are set at 0% and maximum at 100%. These figures are the outer limits but can be increased or decreased to meet the investors’ individual needs. For example, a very conservative investor may have a minimum allocation to government/ semi government bonds of 20% and a maximum allocation of 75%.

Customised Investment Program parameters

Source: FIIG Securities

Once the mandate has been built and agreed, the team will seek to construct a portfolio of risk-return assessed fixed income investments that satisfy the terms set. The team will use an investment and portfolio construction strategy to suit the tailored investment mandate.

A more conservative investment program is likely to apply an investment methodology not too dissimilar to that used in the Core Income investment program.

Likewise, a customised investment program that has a higher risk profile, is likely to adopt a portfolio construction and investment due diligence strategy that is not too dissimilar to that used in the Income Plus investment program.

However, the benefit of this program is the choice is still yours, you still have ownership but the team takes care of the management.

If you have any queries please contact your FIIG Representative or call our offices. Please also note that the Managed Income Portfolio Service Customised Option is available to wholesale investors only with a minimum investment of $5 million.