The long-awaited final report from the Royal Commission into Banking was released without any new damning information. AMP and Bendigo & Adelaide Bank (BENAU) followed-up however by releasing disappointing financial results as far as equity investors were concerned. While their respective share prices dived in response, their subordinated debt bonds remained stable, with their credit profiles remaining largely unchanged.

The Royal Commission into banks, superannuation and financial services began in February 2018, where the depth of the malpractice across the industry was uncovered. AMP arguably fared the worst, losing its CEO, Chairperson, legal counsel and three board members in the fallout, while wiping $1.3bn off its market value at the same time.

Regional banks, including BENAU, were largely a sideshow to the main event, which primarily concentrated on the conduct of the four major banks and AMP. Nevertheless, with the four major banks largely retaining their market dominance following the release of the final report, the hope that the Royal Commission would deliver regional banks including BENAU an increasingly level playing field, were dashed.

Royal Commission findings

In early February 2019, the final Financial Services Royal Commission report was released. Little change between the draft report released in late-2018 sent the share prices of the four major banks and AMP higher in response.

AMP in particular has endured severe reputational damage from the Royal Commission findings. However, vertical integration, the production and distribution of financial products, has not been banned. This is a positive for AMP, leaving a considerable part of its business model arguably intact.

An end to grandfathered commissions for conflicted remuneration will need to be absorbed, while the prospect of further remediation costs are highly probable. AMP’s fee for no service scandal has been referred to industry regulators ASIC and APRA for further investigation, leading to the possibility of both the group and some individuals facing prosecution. AMP has provided $469m to compensate customers for such scandals, although we would expect this to increase.

Another key recommendation is changes to how mortgage brokers are remunerated. The final report recommended that the consumer, not the lender, should pay the mortgage broker a fee for acting in connection with home lending. BENAU has a large physical network, and one of the lower reliances on mortgage brokers. On the other hand, AMP’s banking operations have a considerable reliance on mortgage brokers. Given a staggered implementation and with both sides of government keen to ensure competition within the banking sector is maintained, we believe further developments on this particular recommendation are likely.

For BENAU, while there were few immediate implications for its main operations, as expected, the lack of any significant changes to the structure that underpins the dominance of the four major banks hasn’t necessarily aided their competitive positioning.

Results

AMP and BENAU recently released financial results, disappointing on some details and forward guidance. For shareholders, the prospect of lower cash earnings going forward--the basis for which dividends are determined--sent shares lower for both AMP and BENAU.

The result saw BENAU sell off sharply, ending 76 cents or 6.8% lower to $10.39 on the day. However the sub debt price held steady and even increased 3 cents, with the underlying credit quality of the bank largely maintained. The chart below shows the small increase in price of the 2023 call Tier 2 note against the drop of the share price. The decrease in the share price isn’t ideal for shareholders, but holders of the BENAU 2023 call Tier 2 note are in a better position where the price held steady and they have the certainty of coupon payments.

Source: Bloomberg

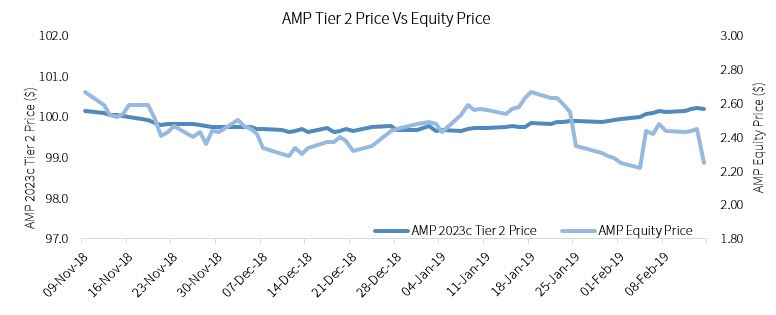

AMP’s full-year results were also disappointing, with profits down by 97%, falling to $28m from $848m from a year earlier. Its share price plunged 10% after the results announcement, and its dividend was at 4 cents in 2018, down from 14.5 cents in 2017. For bondholders, once again there was little movement in the AMP 2023 call Tier 2 note, which was down only 2 cents over the day. For bondholders, they can take comfort in the fact that capitalisation for the group remains strong. The chart below shows the small movement in the Tier 2 note price, compared to the bigger equity dip. Once again its bondholders are in a better position, also having the security of coupon payments.

Source: Bloomberg

Source: Bloomberg

Conclusion

The market was nervously awaiting the Royal Commission final report and the full year results for AMP. The final report lacked any new surprises, with the findings largely priced in. Of the two, AMP faces the greatest level of uncertainty going forward, although we believe the worst case scenario is off the table.

Although both AMP and BENAU had weaker results, which sent their market values tumbling, the respective 2023 call Tier 2 notes were steady, benefiting from little change in the underlying credit quality. Bondholders have the security of more stable pricing and the certainty of coupons until the call or maturity dates. Furthermore, these two notes were issued at wider margins compared to peers, following weaker market sentiment and proposed bank funding. We continue to view Tier 2 notes and those issued by AMP and BENAU in particular as offering relative value and an attractive inclusion in portfolios, even more so with the uncertainty of the Royal Commission final report and recent results removed, for the most part.