Investors looking to achieve higher returns for incremental risk compared to other asset classes need look no further than bonds. Opening a FIIG Direct bonds account has never been faster or simpler with FIIG’s online application process, making it easier to lock in the benefits of a fixed income portfolio.

This document has been prepared by FIIG Investment Strategy Group. Opinions expressed may differ from those of FIIG Credit Research.

Background

Many investors have been caught sitting on spare cash or surplus funds earning minimal income from other asset classes.

In the new norm of unconventional monetary policy investors with spare cash have been hesitant to deploy those surplus funds for fear of taking on too much risk. A quick check of other asset classes shows the options include low risk for dismal returns or higher risk for better returns laden with greater volatility.

For modest incremental risk, bonds offer a known income and the repayment of capital back at maturity for a better return, making them an ideal investment for idle funds.

Furthermore, bonds offer key features over other asset classes including a predictable income stream, liquidity and the opportunity for capital gain.

An investors’ risk appetite will determine the universe of suitable bonds, but investment grade corporate bonds will generally suit most retail and wholesale investors.

In the following note we look at how easy it is to set-up a new Direct Bonds account with FIIG, and the benefits of bonds compared to other asset classes.

Opening a FIIG Direct Bonds account

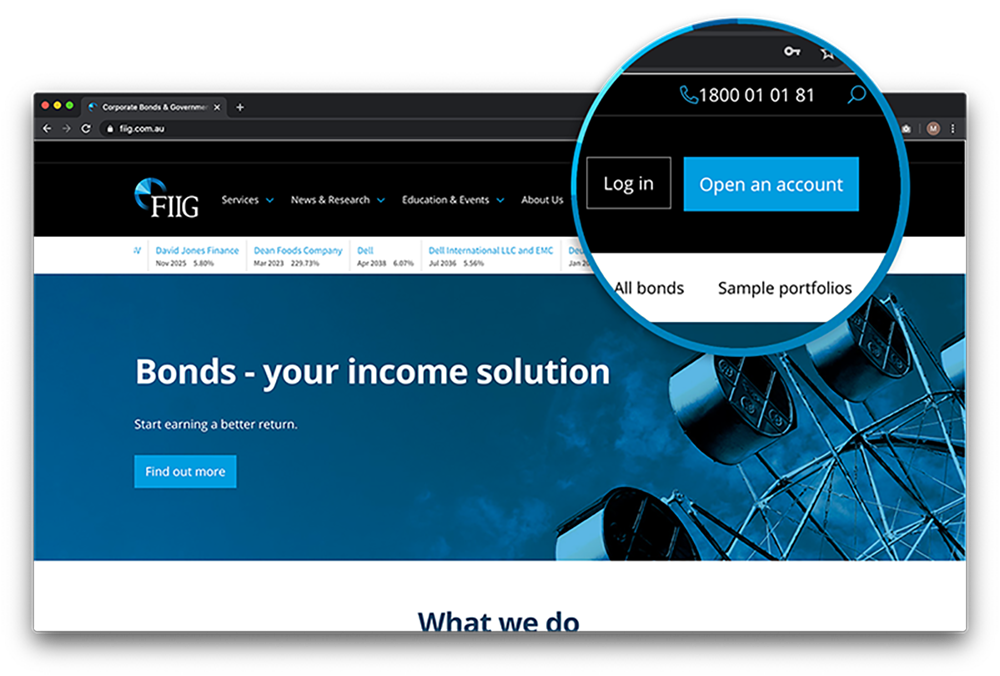

FIIG's ongoing focus on its clients is reflected in its online Direct Bonds application process, available on our website, www.fiig.com.au making opening an account faster and simpler by:

- Showing you only the information required to open your account

- Saving information previously entered to allow prefilling and resumption of uncompleted applications

- Highlighting when you have missed critical information, and

- Automatically checking information, such as your Tax File Number, as you enter it.

Paper applications can be confusing, trying to figure out which options are relevant to your investment entity. The online account opening process starts with what type of account you will be opening, and then steps you through only the information we need to open your account.

You can now accept our terms and conditions electronically and submit the application via a Personal Identification Number (PIN) that is emailed to you. Customer and entity identification processes are run electronically and automatically with the outcome of the verifications visible immediately.

It may be necessary to provide further information. A checklist clearly communicates which documents are needed and allows you to upload them directly to your application.

Setting up your portfolio

If you are new to FIIG, you can request a Relationship Manager if you have been referred to or know one, or our Client Services team will introduce you to one.

While your account is being opened, your personal Relationship Manager will be in contact to discuss your investment strategy.

Each of our clients decide which companies they want to invest in, and every portfolio is bespoke to that individual’s outlook and strategy. It’s your choice to invest in, or not invest in, any company that issues bonds.

Opening a FIIG Securities Direct Bonds account has never been faster or easier, allowing an investor to conveniently open an account and benefit from investing in a fixed income portfolio.

Benefits of investing in bonds

Bonds offer key features over other asset classes, which make them an attractive investment, particularly for idle funds in this low interest rate environment.

The benefits a fixed income portfolio offers include a predictable income stream, liquidity and the opportunity for capital gain, which we further discuss in the following.

Income stream

While other asset classes, such as term deposits, pay interest only at maturity or usually yearly when the term exceeds 12-months, bonds offer a more frequent cashflow. To achieve a more frequent interest payment on term deposits the interest is earned at a reduced rate to compensate, reflecting the lower credit risk.

The interest on bonds is paid either semi-annually, quarterly or monthly, depending on the type of bond. This provides a regular known income stream for investors.

A bond’s issuer has a legal obligation to pay interest payments and repay capital at maturity, and it is considered a default if it fails to do so.

Liquidity

Bonds can be bought and sold relatively easily, and prior to the maturity date, giving investors access to their funds. Bonds are generally a liquid investment depending on market conditions and the type of bond. Government bonds are highly liquid.

Other asset classes may require investors to forgo access to funds for a pre-determined period or are faced with break fees or penalty interest. This isn’t the case for bonds, where only a small margin between buyers and sellers is charged to trade.

Opportunity for capital gain

Bonds trade in the secondary market, where their prices can fluctuate as a result of credit and market conditions. As such they have the capacity to increase in capital value. Not all asset classes offer the opportunity for capital gain, while also locking in a known income.

Bonds can trade at a discount (below the price they were issued), or at a premium (above the price they were issued). Purchasing a bond at a discount means an investor can expect a capital gain if held to maturity, where they will receive the issue or par value (usually $100).

Bonds purchased at a premium can still make a capital gain if market conditions allow and if sold prior to maturity. In the current environment on the back of strong demand and limited supply, spurred by central bank bond buying programs, many bond prices have been moving higher. This has impacted government, semi-government and corporate bonds (bonds issued by companies). Corporate bond prices have also appreciated with credit spreads (the margin over the risk-free rate) tightening reflecting investors’ risk appetite.

It is worth noting a move in interest rates or interest rate expectations will impact the price of fixed coupon bonds. The longer the tenor of the bond, the greater the impact to the price.

Improve returns for incremental risk

Bonds offer improved returns for incremental risk, compared to other asset classes. The chart below shows a simplified bank capital structure, illustrating where term deposits and shares sit in terms of risk compared to bonds.

Source: FIIG Securities

An investors’ risk appetite will determine the universe of suitable bonds, but investment grade corporate bonds will generally suit most retail and wholesale investors.

Term deposits up to $250,000 are government guaranteed, making them a low risk investment. Although it’s worth noting the Australian Government during the financial crisis announced a guarantee scheme for certain state and territory new issues until December 2010. State government bonds have unconditional support from the issuing state.

Conclusion

FIIG’s online application process makes opening a FIIG Direct Bonds account even easier, allowing an investor to conveniently open an account, and set up a fixed income portfolio. There’s even more reason to consider investing in bonds, with low interest rates limiting returns or pushing investors into riskier assets with greater volatility. Bonds offer key features compared to other asset classes, which make them an attractive investment, particularly for idle funds in this low interest rate environment.