Highlighting the key differences between fixed and floating rate bonds in current markets

Key points:

- One important misconception that investors often make is that swap rates are equivalent to the market expectation of forward BBSW rates. For floating rate notes to outperform, rates don’t just need to rise – they need to rise more than expectations

- Swap rates represent the weighted average of all the future BBSW rates out to that date

- Investors in Floating Rate Notes are required to forego income today in the hope of receiving greater income in future

One of the defining advantages of being a self-directed investor is that it gives you the opportunity to act on your personal view about markets, instead of just going along with the consensus.

Recently, we’ve had many clients, concerned about rising interest rates, express an interest in having a heavier weighting in their portfolio towards floating rate instruments instead of fixed. This can be a perfectly reasonable view to hold, however, we find that many clients instinctively underestimate the rate increases that are already priced into markets.

This article intends to highlight the key differences between fixed and floating rate instruments that investors need to be aware of in current markets.

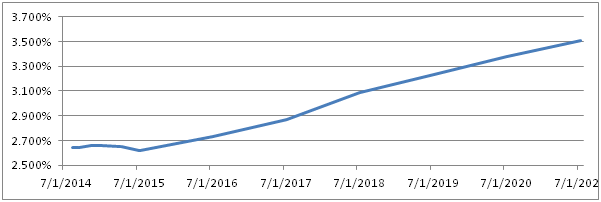

First, whenever we’re talking about comparing fixed versus floating rates, we need to make sure that we remember how interest rate swaps work. At their heart the “swap rate” is the rate at which an investor is indifferent between accepting a fixed or floating rate of interest. For example, Monday’s five year quarterly swap rate was 3.23%. That means that if you give market participants the choice between being paid 90 day BBSW for five years, or being paid a fixed rate of 3.23%, they’d be happy taking either (see Figure 1).

Extended swap curve from Monday 28 July

Source: AFMA, Bloomberg

Source: AFMA, Bloomberg

Figure 1

One important misconception that investors often make is that swap rates are equivalent to the market expectation of forward BBSW rates. Accordingly, they look at the five year swap rate, see that it’s at 3.23% and assume that means that the cash rate will be under that level. Not surprisingly, this makes them think that fixed rate bonds are expensive.In reality it’s a little more complicated.

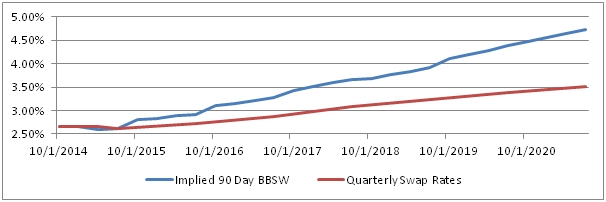

Swap rates represent the weighted average of all the future BBSW rates out to that date. With some pretty easy maths, we can bootstrap what the implied forward BBSW curve is. For example, while the five year swap rate is at 3.23%, the implied 90 day BBSW rate in five years’ time is 3.91% - almost three full 25bps rate increases higher, or double as much over today’s 90 day BBSW rate than the swap rate is. Figure 2 shows the extended curve.

Swap Rates and Implied 90 Day BBSW Rates (as at Monday 28 July, 2014)

Source: AFMA, Bloomberg, FIIG Securities

Source: AFMA, Bloomberg, FIIG Securities

Figure 2

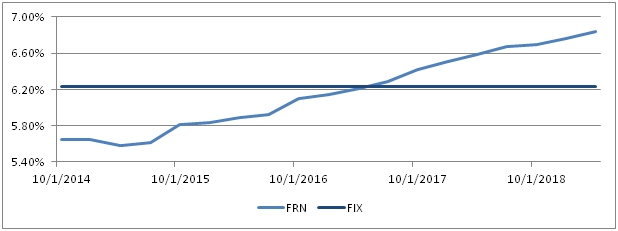

The next important point to remember is the cashflow profiles of equivalent fixed or floating rate securities will look like over time. Let’s suppose that XYZ Corporation issued two five year bonds on Monday; a fixed rate bond paying five year swap plus 300bps and a floating rate note paying 90 day BBSW plus 300bps. Figure 3 shows the interest income that investors would expect to receive over the life of the investment.

Hypothetical XYZ Corporation fixed and floating rate interest income rates

Source: AFMA, Bloomberg, FIIG Securities

Source: AFMA, Bloomberg, FIIG Securities

Figure 3

Not surprisingly, the fixed rate bond pays a steady coupon of 6.23% for the life of the bond, however, with the floating rate note, investors are required to forego income today (initially earning just 5.65%), in the hope of receiving greater income (up to 6.84% in the example) at the back end of the investment. It is important to note that it is just a hope – while there is certainty about both the income that the fixed rate bond will pay, and the fact that the floating rate note will pay a lesser amount of income initially, there’s no certainty about future payments on the floating rate note.

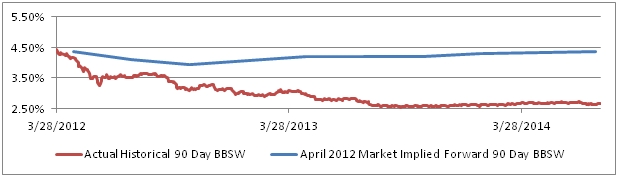

The actual amount of interest paid on the floating rate note has the potential to be either substantially more or substantially less than expected depending on where short term interest rate markets move. By way of example, Figure 4 shows the actual historical 90 day Bank Bill Swap Rate (BBSW) as well as the market implied expectations for forward BBSW rates from April 2012.

Extended swap curve from Monday 28 July

Source: AFMA, Bloomberg, FIIG Securities

Source: AFMA, Bloomberg, FIIG Securities

Figure 4

The example in Figure 4 highlights that if an investor had bought a floating rate note in April 2012, the actual income they would have received would have been substantially less than the market’s expectations. Of course the opposite is also true (where rates could increase more than expected leading to a windfall gain), however, this demonstrates the benefit of the certainty that fixed rate instruments provide.

Conclusion

As many investors are expecting interest rates to rise, it can be easy to think that floating rate notes by definition represent a better option. This article has demonstrated that just because you expect rates to rise doesn’t mean that you should have a preference for floating rate notes – it wholly depends on whether you think that rates will rise more than markets are already expecting.

Importantly, when considering floating rate notes, investors should remember two key points:

1) Swap rates don’t represent future expectations of short term interest rate levels, but an average that’s weighed down by today’s low rates.

2) Floating rate note investments fundamentally require accepting a lesser return in the short term in the hope of higher returns in a future about which we cannot be certain.

Ultimately, considering these facts, I’m an advocate for a balanced portfolio among fixed, floating, and inflation linked notes which will protect me against a variety of uncertain future outcomes.