Margins and outright rates for term deposits have steadily decreased this year;however, notice saver and 'hub' accounts will provide opportunities in 2015 as the term deposit landscape undergoes the most significant change since the onset of the GFC.

Key points:

- Both margins and outright term deposit rates have fallen over 2014. On average margins contracted around 30 basis points (bps) from the start of the year, offset by a 5 – 10 bps increase in the bank bill swap rates (BBSW) across the various maturities, combining for an overall fall in outright rates by 20 – 25 bps

- Both margins and BBSW/swap rates are expected to continue the declining trend, further lowering outright rates on term deposits in 2015

- However, the pending Basel III/Liquidity Coverage Ratio (LCR) regulatory changes that commence on 1 January 2015 will provide opportunities for higher returns from notice saver and ‘hub’ accounts

- And don’t forget the government guarantee covers the first $250,000 per entity per Authorised Deposit-taking Institution (ADI). Investors should seek out the highest rate available irrespective of the ADI for any amount that is covered by the government guarantee

Review of term deposit margins and outright rates

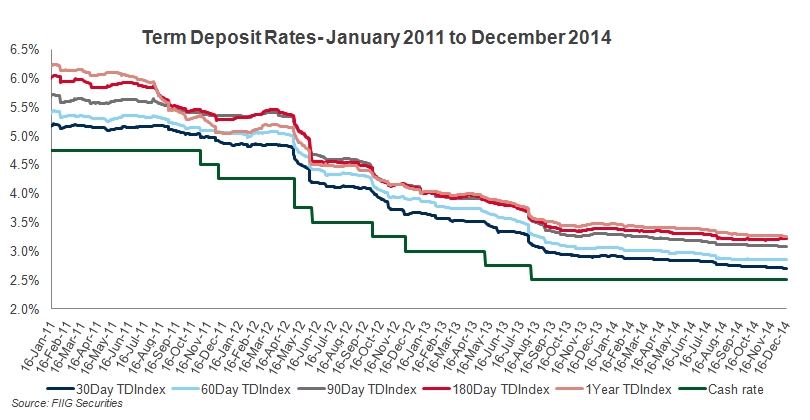

Both margins and outright term deposit rates fell over the past 12 months as base rates and competition for deposits continued to subside (as demonstrated by the two FIIG Term Deposit Index charts below that average all the rates provided via FIIG Securities’ term deposit service).

Figure 1 below shows that in 2014 margins contracted around 30 basis points (bps) on average. While the 180-day and 1-year margins have spiked in the last month or so, this is more a reflection of the outrights rates remaining the same while the 6 month and 1 year swap rates have fallen as the market started pricing in rate cuts in 2015. We expect these spikes in margins to be removed as ADIs lower their longer term rates in line with lower swap rates.

Figure 1

The trend of declining term deposit margins has been in place since June 2012 as competition for deposits decreased with banks increasing funding sourced from other traditional markets such as domestic and overseas bond markets and residential mortgage backed securities (RMBS). Access to these funding markets was severely limited in the years immediately following the GFC and required the banks to significantly increase their deposit funding thus offering higher margins to attract deposit funds. However a gradual recovery global funding markets combined with a general reduction in credit spreads has seen the pressure released on the local deposit market.

The above mentioned margin compression was slightly offset by a 5 – 10 bps increase (depending on the maturity) in BBSW/swap rates in 2014. Combining the margin and base rates, average outright term deposit rates declined around 20 – 25 bps over the past year, continuing the trend that started in January 2011 (see Figure 2 below).

Figure 2 While margins have been falling, the main cause of lower term deposit rates has been lower base rates (i.e. cash rate/BBSW).

We expect both base rates and margins to continue to fall in 2015 as alternative funding sources for banks track towards historic norms, further reducing competition for deposits. (Should risk aversion increase and global credit spreads rise, this may see a short-term return of heightened competition for domestic deposits. However, this would more likely be a short term event as opposed to a reversal of the declining trend).

Notwithstanding these trends, there will be opportunities for cash and term deposit investors in 2015 courtesy of changing regulation.

Opportunities for cash and term deposit in 2015

Average term deposit rates (using the FIIG Term Deposit Index) now range from circa 2.7% for 30-days to 3.0% for 1 year, however, an additional 50bps over the average is typically available, including the following:

- 30-day 3.20%

- 60-day 3.35%

- 90-day 3.41%

- 180-day 3.57%

- 1 year 3.55%

Source: FIIG Securities. Note: The above rates are accurate as at 15 December and are subject to change. Minimum amounts range from $20,000 to $500,000 depending on the institution.

Considering the cash rate is currently 2.5%, with many economists now predicting it to hit 2.0% in 2015, these rates while low, may still appeal.

However, 2015 will also see a significant change in the deposit landscape as a new regulation known as the Liquidity Coverage Ratio (LCR) is implemented. A detailed description of the LCR and its implications was published in the WIRE on 19 November 2014 ‘Is this the end of the traditional term deposit?’

1. Notice saver

‘Notice saver’ accounts contain a 31+ day break clause, which satisfies the LCR above. In 2015, we expect this product to become the predominant type of deposit product for wholesale investors and larger balances (over $250,000).

At present, FIIG Securities can organise a notional ‘Notice saver’ account/rolling deposit from a highly rated Australian regional bank that is paying 3.30% or 80bps over the cash rate. There is no fixed term, however investors must provide the bank with 30 days notice to redeem the funds.

Given the additional flexibility and fact there is not an RBA meeting until February 2015 (i.e. no opportunity to cut rates), this is viewed as an attractive rate compared to the slightly higher rates detailed above for longer fixed terms. Further, it is from a significantly stronger ADI, which is important for any amount over the $250,000 government guarantee.

2. ‘Hub’ account

The other important opportunity is to make the most of cash that comes in and out of your investments, typically via coupon and dividend payments (and purchase and sale of bonds and shares). Investors should ensure they have a cash ‘hub’ account which combines emergency ‘at call’ cash (something all investors should have in their portfolio) with any surplus funds from investing. This is typically maintained in a ‘hub’ account from which all investment payments and receipts are made.

Not only does a ‘hub’ account make it easier at tax time and to organise payments for new investment purchases, under the new deposit regulations, the ‘operational’ nature of such an account will enable ADIs to pay a reasonable rate of return.

It is not uncommon for investors to earn no, or sub-cash rate, returns on their transactional accounts that they use for the receipt and payment of their various investments. And it is also not uncommon for the balance of these accounts to be well over $100,000. Investors should ensure they consolidate their accounts into one ‘hub’ account that pays a solid return as this forgotten cash is too often left earning no or minimal return, despite a high balance year after year.

3. And don’t forget the $250,000 government guarantee

And finally, don’t forget the existence of the government guarantee which covers the first $250,000 per entity (i.e. you could have $250,000 in your name and another $250,000 in your spouse’s name, all fully guarantee) per ADI (i.e. you could have $250,000 in Bank A, $250,000 in Bank B, $250,000 in Bank C and so on, all covered by the government guarantee). Investors should seek out the highest rate available irrespective of the ADI for any amount that is covered by the government guarantee.

The article ‘Is this the end of the traditional term deposit?’ highlights some other ‘tricks of the trade’ to ensure you maximise your return from cash and term deposits.

For further information on the pending changes or to review current deposit rates available, please contact the Short Term Money Market team on 1300 337 674 or email to td@fiig.com.au.