We explore the issues driving financial market volatility and derive four investment strategies to consider

This year is delivering on its promise of global economic volatility. There has been a lot of news in recent days, but the key issues for income seeking investors are:

- The US Fed will keep waiting for real jobs growth before it increases interest rates and that is still a way off.

- Equity markets are jumping at (Greek) shadows giving us a glimpse of a looming correction when confidence falls so far that we shift to a bear market.

- It is China that is making the world nervous more so than Greece.

- Currency markets are showing signs of greater volatility, which is bad news for the AUD.

First, I’ll cover four specific investment strategies for you to consider then detail four important global themes.

Four investment strategies for income-seeking investors in a volatile world

Depending on your own views and circumstances, if you want to:

1. Take some risk off the table

- Reduce international equities (see Global Theme 2) before considering reducing Australian equities

- Diversify high yield exposures - because it’s always a good idea

- Shift from USD investments to GBP as the AUD/USD rate slips further below 75c (Global Theme 4)

2. Gain from the volatility

- Buy long dated USD corporate bonds where the US 10 year Treasury yield is above 2.20%p.a. (Global Theme 1)

- If you are looking to enter equity markets, there will be several large market dips over the remainder of 2015 (Global Theme 2)

- If you are brave and happy to accept the accuracy of reporting out of China, Chinese equities are now down to 18x current year P/E ratio, which when compared to 15x in Australia and 16x in the US, is good value given the much higher GDP growth in China (Global Theme 3)

3. Avoid China risk specifically

- Reduce exposure to Australian equities rather than international equities (Global Theme 3)

- Avoid Chinese equities but also watch for sectors in Australia that are heavily dependent upon China, e.g. resources, building and REITs (Global Theme 3)

- Hedge against a falling AUD which is a likely outcome from China nervousness (Global Theme 3)

4. Avoid the risk of an equities market correction but need income above what deposits are paying

Global themes

1. The unemployment rate the Fed really cares about

Like most of its global peers, the Fed is charged with maximising employment whilst keeping prices (inflation) stable. Last week the “non-farm payrolls report” came out in the US showing unemployment at 5.3%, the lowest level since 2008 and just 0.5% away from what central bankers call the “natural rate of unemployment”. Simplistic assessment of this headline unemployment rate would conclude rates will rise soon.

However it’s not that simple. The Fed’s mandate is to “maximise employment” not “minimise unemployment”. This is a significant difference. People who drop out of the workforce and those working part time because full time employment isn’t available are not counted in the unemployment headline rate. However, they do matter to the Fed because they want these people to be able to work as much as they want to.

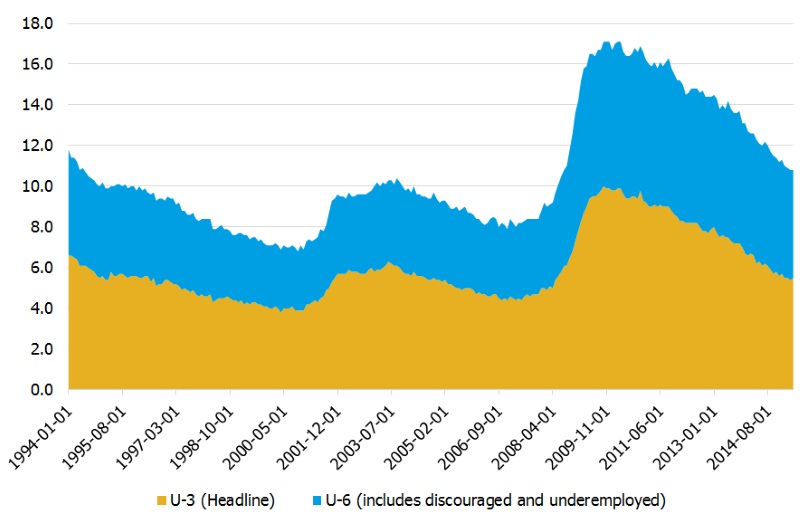

The measure the Fed really follows is called “U-6”. This measure includes everyone looking for more work:; people looking for work now, looking for more work now, or who would like to look for work but have been discouraged. As opposed to the headline U-3 unemployment rate which is currently at 5.3% and at its long term average, U-6 is currently at 10.5% and well above its long term average of 8.9%, as shown in Figure 1.

US Unemployment measure that really matters

Headline US Unemployment is 5.3%, but this number is misleading. It excludes all the people that have been discouraged by years of recession and those that have accepted part-time work but would rather work full time.

Figure 1

Source: FRED, FIIG Securities

The unusually high gap between U-3 and U-6 is a function of the severe recession that the US experienced recently and the prolonged slow recovery. This has caused a large portion of the population to stop looking for work (discouraged) or accept less work than they would like to (under-employed).

The Fed watches unemployment for two reasons: firstly they prefer to keep rates low for as long as they can to encourage job creation; and secondly they know that when unemployment falls too low, employers start competing for labour and wage inflation kicks off, which turns into broader inflation.

In other words, they keep rates low to create jobs until too many jobs have been created and inflation risk is rising.

Until U-6 falls to below its long term average, the Fed will be under no pressure to increase rates. And as discussed, the Fed will not move until they absolutely must. This is because they fear the risk of moving too early and thereby damaging the recovery much more than they fear waiting too long.

Strategy implications

Long dated USD corporate bonds will benefit as the market adjusts to the Fed’s bias towards patience, not focus on short term headlines. USD remains the strong play as the US economy is clearly recovering, but the recovery is not as strong as markets are implying, meaning investors can buy high yield bonds at mispriced levels until the market catches up.

2. Equity market nerves - It wasn't about Greece.

The big news of the week was Greece, but the real news isn’t Greece itself but the skittishness of markets. Wiping 350 points of the Dow Jones reduces the value of the companies on the Dow by US$600bn. Greece’s total debt is less than US$400bn. So, even if the 30 companies on the Dow chose to pay off Greece’s entire public debt, the Dow should have fallen less than it did.

So what does that mean? Clearly Greece was not the problem, despite the headlines. The problem is fear.

Global equity markets are addicted to cheap debt and eventually the Fed will cut off their supply. Those in the know, fear that markets are priced for perfection when the world economy clearly isn’t perfect. That puts investors in a precarious position as markets will eventually right themselves one way or another.

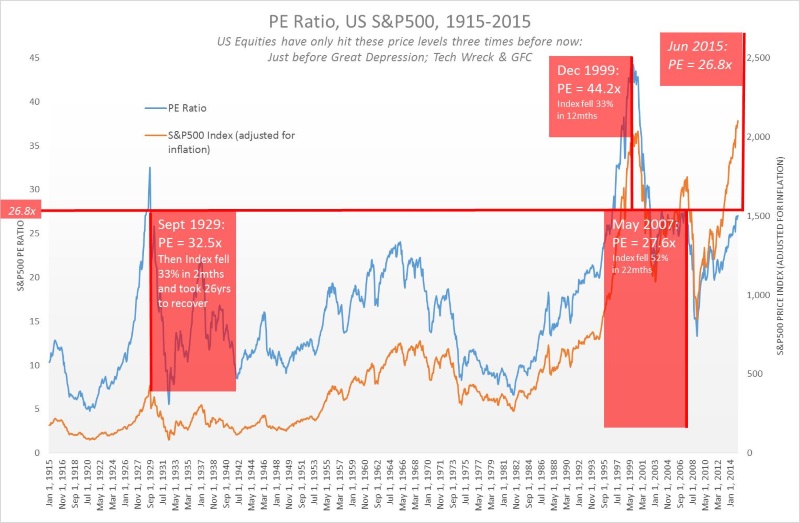

Figure 2 below illustrates what we mean by “priced for perfection”. This chart shows one of the most widely acclaimed and (importantly!) independent measures of long term market value: Dr Robert Shiller’s CAPE (Cyclically Adjusted Price-to-Earnings) ratio. This ratio uses actual (not forecasted) earnings, removes the impact of inflation and interest rates, and compares earnings to price over a ten year period to remove short term noise.

The current CAPE level of around 26-27x implies that values are so high right now that expectations for equities returns over the next ten years are near zero. This doesn’t mean a correction is imminent – prices could still go higher as they did in 1996-1999. What it does mean that they are so far above average that eventually prices will fall and, unless you can time your exit well, you will experience very low returns.

This time the likely cause of this correction is the end of cheap debt, that is, the Fed choses to increase interest rates and the equity market should correct. Importantly, while we said in Global theme #1 above that rates will not rise as far as the market expects, they will still rise. When this happens, Wall Street will lead the global equity markets in an unprecedented unwinding of leverage and eventually reach a new valuation level. It is impossible to predict what this will be as the current period of near zero interest rates is unprecedented. For investors that can’t afford a sharp correction in their portfolio, this could be a good time to derisk.

Priced for perfection: US Equities Long-term PE Ratios

Figure 2

Source: FRED, Damodaran Online, FIIG Securities

Strategy implications

While the equities correction mightn’t be immediate, valuation levels globally are well above average. For investors who cannot afford another major correction it is worth considering derisking your portfolio now. Switch higher risk equities for high yield bonds but keep to lower durations, for example below five years. This will allow maintenance of 5-8%p.a. returns, but will also lower the impact a 20% plus equities market correction would have.

3. China nerves

China makes everyone nervous and with good cause, particularly for Australians. China’s economic growth outlook drives commodity prices. Since 2011, the IMF has named China as the largest economic risk the global economy faces. At the same time, China’s economic data is seen as less reliable or even manipulated, and its property market is often considered dangerously overheated.

Last week, China’s equity market collapsed, falling 14% in a week and 26% for the month. This is after an extraordinary 140% rise over the prior 12 months. Much of the rise is attributed to leverage, particularly retail investors borrowing to invest in the market. This brings Chinese equities back to an average P/E ratio of 18x, compared to 15.3x in Australia and 16.2x in the US.

The good news is that this decline was probably caused by unexpectedly good economic news. Good news has caused investors to believe that the days of cheap leverage provided by China’s central bank are likely to end sooner than expected. The end of cheap debt means less money entering the market, which means lower prices.

The good news out of China recently has been:

- PMI (Producers Manufacturing Index) rose from 49.2 to 49.6, still below the 50 level that separates contraction from expansion, but a move in the right direction.This is is mildly positive for Australian iron ore producers, although still a long way from being high enough to support higher iron ore prices.

- Service sector PMI rose steeply to 51.3 from 49.5 in May.Services now make up nearly 50% of China’s GDP, more than manufacturing and construction.

- Property markets have stopped falling. The sales index for the 100 largest cities rose nearly 0.5% in May, the highest climb since early 2014 when the central controlled government curbed lending to the sector.Since then, property prices declined 15 months straight, creating concerns that the rapid decline could harm the overall economy.

- Unemployment has stabilised at 5.1%.

Chinese equities plummeted 26% in the last month as a result of good news

China’s extraordinary stock market performances over the past year are largely attributable to the availability of cheap leverage for retail investors. Good economic news, if it continues, will put an end to this.

Figure 3

Source: Bloomberg FIIG Securities So what does this all mean? There are only two relevant points to watch for China:

1. Avoidance of a "hard larding."

If China manages to stabilise its slowdown, this will be good news for the Australian economy. One week of good news does not mean China has turned the corner. The risks are still very much on the negative side, but the hard landing scenario is fading. This is particularly good news for investors exposed to the iron ore price.

2. Declining current account surplus.

Whether or not China grows at 7% p.a. or 6% p.a. matters little to the rest of the world.What matters is whether they are contributing to net demand or net supply.If their current account surplus is falling, this means that they are contributing more to net demand. That is they are buying more from the rest of the world.If their economy slows to 3-4% but they buy more from the rest of the world, the global economy will benefit.

Strategy implications

In the event China’s data keeps surprising on the upside, then watch for a turnaround in the iron ore price, not to mention their equity markets. As it is still early days, this is only one for the brave at this stage.

In considering how to avoid the inevitable volatility that will be caused by the market’s nervousness about China as it makes the transition to a lower growth economy, there is no escaping the point that Australian equities are highly exposed, far more so than the equities of the US or Europe. The challenge is derisking in a way that doesn’t reduce your overall returns so far that you don’t earn enough to meet your needs. A gradual shift from equities to property (not listed), corporate bonds, foreign currencies or infrastructure (not listed) will reduce exposure to China without reducing total returns greatly.

4. Currency volatility continues to rise.

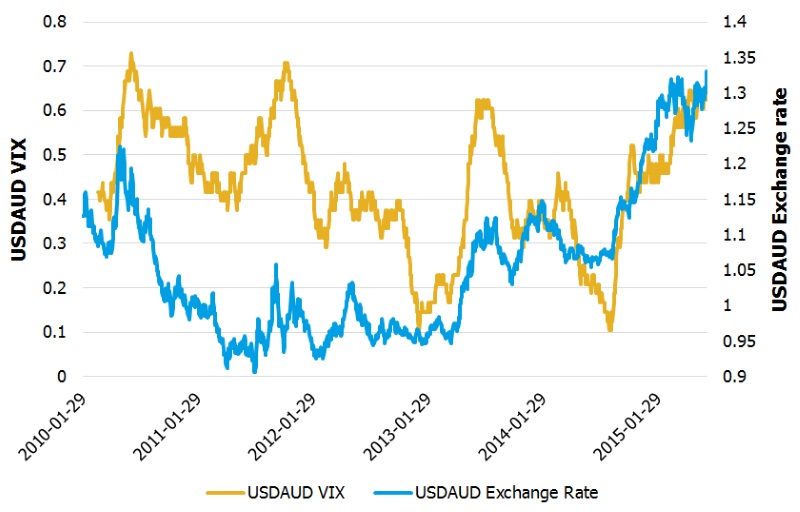

Currency market volatility has also been a feature of 2015. Many readers will be familiar with the Volatility Index (VIX), commonly referred to as the “fear index” for equities markets. Figure 4 below shows a similar index for the AUD/USD exchange rate. It shows that the AUD is particularly susceptible to currency market volatility.

With volatility increasing in the past two weeks, and likely to continue to increase in the next few weeks as the fallout from Greece’s “no” vote is absorbed, will likely mean that the AUD corrects to new levels in the short term.

Currency VIX – AUD has fallen against the USD when currency volatility is rising

The exchange rate below is the USD’s value in AUD terms so it is the inverse of what we are used to seeing. It is shown this way to show the relationship to volatility. 1.25 USDAUD is the same as 0.80 AUDUSD.

Figure 4

Source: FRED, FIIG Securities

Currency markets are now aligning to fundamentals rather than the flight to safety cycle seen immediately after the GFC. This means markets will adjust to economic growth and trade prospects for each economy more predictably. This is positive for the stronger economies of the US and UK, and likely to result in further weakness for the Euro, AUD, Yen and NZD. China’s CNY is as always the unknown and the high risk play.

Strategy implications

Combining USD or GBP corporate bonds with a portfolio of Australian equities and other AUD assets such as term deposits or property is a powerful hedge strategy. In the event that global economy weakens, the USD will strengthen relative to the AUD and so gains on currency will offset equities losses.

In the event that the global economy continues to recover, the USD will benefit due to the US economy’s headstart on its trading partners. But in the event that Australia recovers faster than expected and the AUD rises against the USD unexpectedly, investors will still benefit from rising Australian equities.