Australia’s “Unemployment Rate” understates the real challenge ahead for the Australian economy. The percentage of the labour force that is currently “underemployed” is at its highest level on record. This is the figure that the RBA will be targeting, not unemployment, because that’s their job maintaining full employment. Until they achieve full employment, they will hold rates at much lower levels than they have in the past

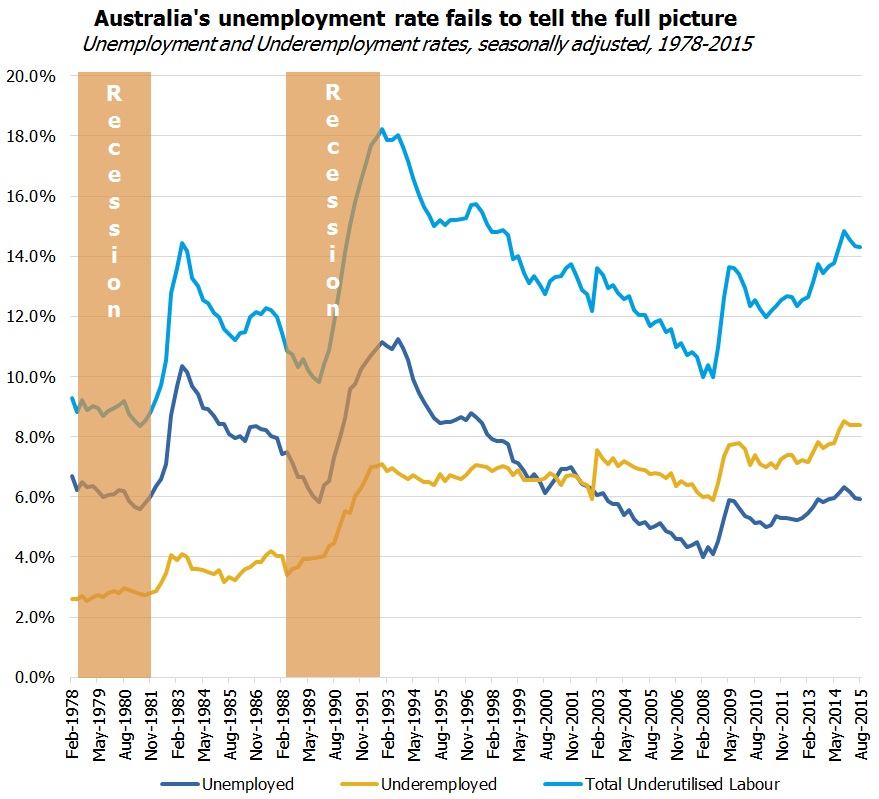

Australia’s headline unemployment rate is 6.2%. This is below its long term average of about 7%, and so using this unemployment rate alone we could mount a case that the Australian economy is in good health, and that the RBA should be biased toward increasing rates or at least holding them.

But this measure of unemployment is deeply flawed. It includes people that want full-time work but can only get part-time work, or those that work part-time but aren’t getting as many hours as they want.

The better measure of the health of an economy is the “underemployment rate”. Those readers that have attended our economic seminars or webinars recently may recall that in the US they call this the “U-6” unemployment rate, as opposed to their headline unemployment rate which is called “U-3”. In Australia we have the headline “unemployment rate” and we separately measure “underemployed persons”. Australia’s underemployment rate is at its highest level on record. A massive 8.4% of the labour force is working part-time and wants more hours (note that this excludes people that are part-time and happy with their hours).

If we add unemployment to underemployment, to give underutilised labour the figure is a massive 14.3%, the highest level since the 1990s “recession we had to have”, and higher than the early 1980s recession.

Source: FIIG Securities, RBA

Why is this relevant? Central banks, like the RBA in Australia, are responsible for maximising employment while keeping inflation in their target range. In the RBA’s case, the target inflation range is 2-3% per annum and inflation is below this range at present at 1.7% pa (1.5% pa excluding volatile items such as petrol). As long as inflation is not at risk of exceeding the 3% pa upper end of the range, the RBA’s key objective must be employment growth and therefore they must keep rates lower.

The key misunderstanding about the RBA is that their role not to minimise the unemployment rate; it is to maintain full employment, while keeping inflation in the target range. Full employment means that the labour pool is fully utilised and therefore doesn’t have some of its labour pool working less than they want to. Imagine for example that you run a business with 100 employees. Fifty of those employees are working at full capacity but the other 50 are idle for 2-3 hours a day because you haven’t got enough equipment to keep them working. You will act to get the workforce back to full utilisation one way or another. The Australian economy is just a much larger version of this business, and the RBA’s job is manage that economy with the tools at their disposal, namely interest rates.

This is the core argument for reducing interest rates further. The Australian economy has large pools of underutilised labour. There is an argument to suggest that these people have the wrong skills, but the RBA’s job is not to create jobs in the right sectors; in these economic conditions their job is to lower interest rates to create the conditions to encourage businesses to invest more overall. If jobs are created in sectors without available labour, inflation will be higher as wages rise and then the RBA will be forced to increase rates again. But failing an inflationary lift, the RBA will continue to keep rates lower until this underutilised labour pool is employed fully.

So with full employment so far from reality and Australia’s economy in major need of an injection of investment to create new jobs, rates will be lower for longer. There are two possible paths for this outcome, and both of them lead to the Australian 5 year and 10 year bond yields being much lower than current levels. The first path is that the RBA lowers rates slightly, say to 1.5% pa, and then leaves them there until either inflation or employment is higher. The second path is a more dramatic fall to 1.0% pa in an attempt to lower the AUD to below 60 US cents and create jobs, then increase rates but only enough to hold off inflation.

Both paths lead to the conclusion that the long term rates in Australia will decline as the market adjusts to the new reality for the Australian economy. For those holding long term bonds, this will mean they are earning higher yields than otherwise available in the market. For those relying upon bank deposit interest, this is bad news. The headlines in Australia’s media suggests that the market is slowly coming to this realisation and so pricing on bonds will lift over the next 12 months to lower rates toward a more realistic outlook in which cash rates are between 1.5% and 2.5% for at least the next five years if not ten or more, bringing the ten year bond yield down from its current 2.69% pa to between 1.75% pa and 2.25% pa.