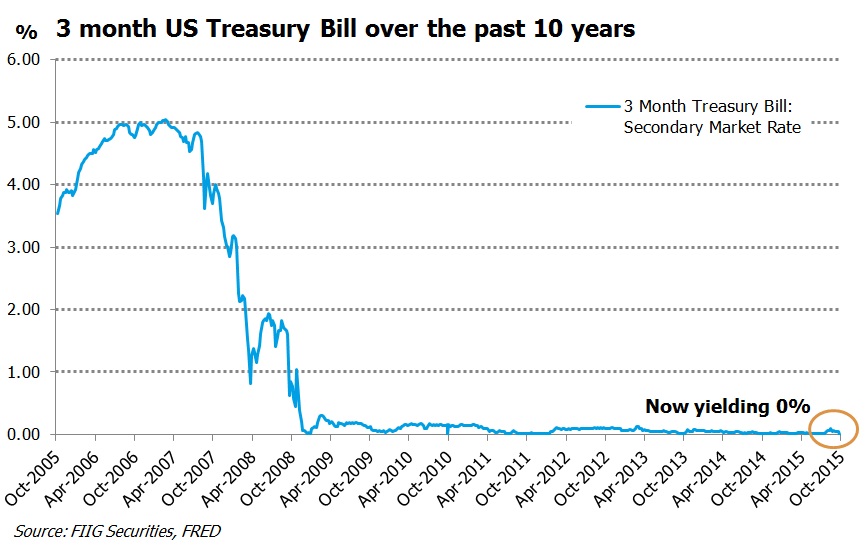

On Monday in the US, the US Treasury was able to sell $21bn of 3 month bonds at 0% yield, a record low. Depending on your view of future interest rates longer term fixed rate investments are looking like good value

The US government, via its Treasury, sells debt securities at an auction several times a week. Once a week, there is an auction for 4 week, 3 month and 6 month “bills” (short-dated government bonds).

For the first time on record, the 3 month Treasury bill has been sold at auction for a yield of 0%. Despite ultra low US interest rates for the last seven years, this is the first time that there has been so much buying demand for government securities, that the government hasn’t had to offer any interest at all. Institutional investors are effectively offering an interest free loan to the US government in return for a risk free highly liquid place to park their money. Even more interesting is the fact that the Fed’s December meeting falls within this three month period, meaning that enough investors believe that the Fed won’t raise rates in December or they are willing to forego this interest for the security and liquidity of US Treasury bills.

This is understandable given the poor jobs data out on last Friday. But that is where the logic seems to end. The US stockmarket’s response to the weaker than expected jobs data, rather than to fall on the logical conclusion that lower jobs growth means a weaker economy which means lower earnings, was to jump nearly 2%. Equally illogical was the response by the US 10 year government bond, jumping back above 2%, implying that rate expectations rose off the back of weak data.

The cause has nothing to do with fundamentals and everything to do with short term flows of large amounts of cash managed by short term institutional fund managers and traders. Lower interest rates, even if just for a few more months, means these investors pour their funds into risky asset classes such as equities and commodities and out of lower risk assets such as long term bonds. If you think you can shift that money back in time to avoid the inevitable correction that happens when markets price a weaker economy in, lowering equities and increasing bond prices, this behaviour might be logical. But for investors looking for more income and stable capital, this short term behaviour creates opportunities.

Key points for investors :

- Poor economic data shocks the market. This time it was poor jobs data out last Friday.

- The market responds by assuming that the Fed is unlikely to move in the next three months.

- So institutional investors that need to hold some cash or short dated investments (for example fixed income ETFs) demand large enough allocations to Treasuries that the interest rate is pushed down to zero.

- Investors that have a choice about where to invest shift into riskier assets such as shares. This shift of funds into shares puts the price of shares up.

- The same investors sell low risk assets such as long term Treasury securities, like the US 10 year government bond, meaning its price falls and the yield rises.

- So far the “logic” is that the economy is worse, so we should buy more equities and sell bonds. This seems illogical unless you are a trader paid to maximise day-to-day profits on your employer’s assets.

- But for investors without this day-to-day focus, the key is to understand that eventually the Fed will increase rates and so steps 2-5 above need to be reversed.

- When the Fed goes, investors that have accumulated bonds at temporarily higher yields will profit, and those investors that have bought into the equity market rally and haven’t sold out in time will lose.

Even taking into account this institutional behaviour, the response from the market is pretty extraordinary. On the “eve” of the first interest rate increase from the Fed in almost a decade, the market has its first ever 0% interest rate 3 month bill auction.

This isn’t all about the jobs data however. The other factor at play now and for some years if not decades to come - is the massive shift of wealth into lower risk assets, and so the competition for low risk assets such as bonds has been rising. As the Baby Boomer generation enters retirement and lower their investment risk and seek investments that offer reliable income and capital preservation, there will be more and more demand for bonds. Similarly as they stop working and spend less, the economy will be slower than we have experienced during the past few years when this generation has been at their peak wealth. So the decline in the interest rate from 3 month bills to this new low point of 0% is not a reflection of the health of the economy, but more a reflection of the high volumes of demand for low risk assets and limited supply.

The market is just now catching up with the “new normal” investment outlook - low economic growth globally means lower interest rates for 10 years or more. For investors already in corporate or government bonds, this will be good news. For those in equities and therefore relying upon higher company earnings, this is bad news as their Price-to-Earnings (PE) ratio is hard to justify and eventually prices will need to fall to reflect this.

Updated 12 October 2015

Below are two portfolios constructed by Head of Portfolio Strategies, Ryan Poth. Both are for an investment amount of $1 million, the first is AUD and the second is USD, all investments are senior debt. Please note that the dollar values in the USD portfolio have been converted back to AUD in these portfolios (using current spot rate as at 12 October). Floating rate note bonds have specifically been excluded from the portfolios as they were constructed with the lower for longer view. There is a minimum amount of 60% allocation to investment grade bonds in each.

AUD longer dated bond portfolio

| Portfolio exposure statistics |

| Weighted Average Yield to Maturity | 6.24% |

| Weighted Average Running Yield | 5.49% |

| Weighted Average Term to Maturity | 9.60 |

| Issuer | Maturity date | Coupon | Bond type | Yield to maturity | Income (running yield) | Price | Face value | Capital value |

| Sydney Airport Finance | 20 November 2030 | 3.12% | Capital indexed bond | 5.79% | 3.19% | 123.12 | $175,000 | $215,457 |

| Adani Abbot Point Terminal | 29 May 2020 | 6.10% | Fixed | 5.67% | 6.00% | 101.70 | $210,000 | $213,570 |

| RWH Finance | 30 June 2033 | Annuity | Indexed annuity | 6.02% | 4.29% | 95.39 | $220,000 | $209,860 |

| G8 Education | 7 August 2019 | 7.65% | Fixed | 6.45% | 7.36% | 104.00 | $50,000 | $52,000 |

| SCT Logistics | 24 June 2021 | 7.65% | Fixed | 7.02% | 7.43% | 102.90 | $50,000 | $51,450 |

| W.A. Stockwell | 29 June 2021 | 7.75% | Fixed | 7.19% | 7.56% | 102.60 | $50,000 | $51,300 |

| Integrated Packaging Group | 29 September 2019 | 7.30% | Fixed | 6.86% | 7.19% | 101.50 | $50,000 | $50,750 |

| PMP Finance | 17 September 2019 | 6.43% | Fixed | 6.05% | 6.35% | 101.30 | $50,000 | $50,650 |

| Cash Converters International | 19 September 2018 | 7.95% | Fixed | 7.60% | 7.88% | 100.90 | $50,000 | $50,450 |

| McPherson's Limited | 31 March 2021 | 7.10% | Fixed | 7.85% | 7.34% | 96.70 | $50,000 | $48,350 |

| $955,000 | $993,837 |

USD longer dated portfolio

| Portfolio exposure statistics |

| Weighted Average Yield to Maturity | 7.28% |

| Weighted Average Running Yield | 7.13% |

| Weighted Average Term to Maturity | 16.35 |

| Weighted Average Rating | BBB- |

| Issuer | Maturity date/call date | Coupon | Bond type | Rating | Yield to maturity/call | Income (running yield) | Price | USD face value | AUD capital value |

| Kinross Gold | 15 March 2024 | 5.95% | Fixed | BBB- | 8.29% | 6.92% | 86.00 | $190,000 | $223,302 |

| CBS | 15 August 2044 | 4.90% | Fixed | BBB | 5.13% | 5.07% | 96.57 | $170,000 | $224,351 |

| Newcrest Finance | 15 November 2041 | 5.75% | Fixed | BBB- | 7.48% | 7.16% | 80.27 | $200,000 | $219,396 |

| BlueScope Steel Finance | 1 May 2018 | 7.13% | Fixed | BB | 6.51% | 7.02% | 101.43 | $120,000 | $166,329 |

| NCIG Holdings | 31 March 2027 | 12.50% | Fixed | Ba2 | 9.32% | 10.24% | 122.06 | $100,000 | $166,813 |

| $780,000 | $1,000,191 |