Published in The Australian 10 October 2015

No one knows if interest rates are going up but professional investors use the swap or yield curve to help form views about their direction and allocate funds accordingly

Simply, the yield curve represents the market’s future expectations of interest rates across a number of maturities and it changes on a daily basis. The curve is used by financial institutions and bond market participants to price both fixed and floating rate investments, so is an important tool and worth watching.

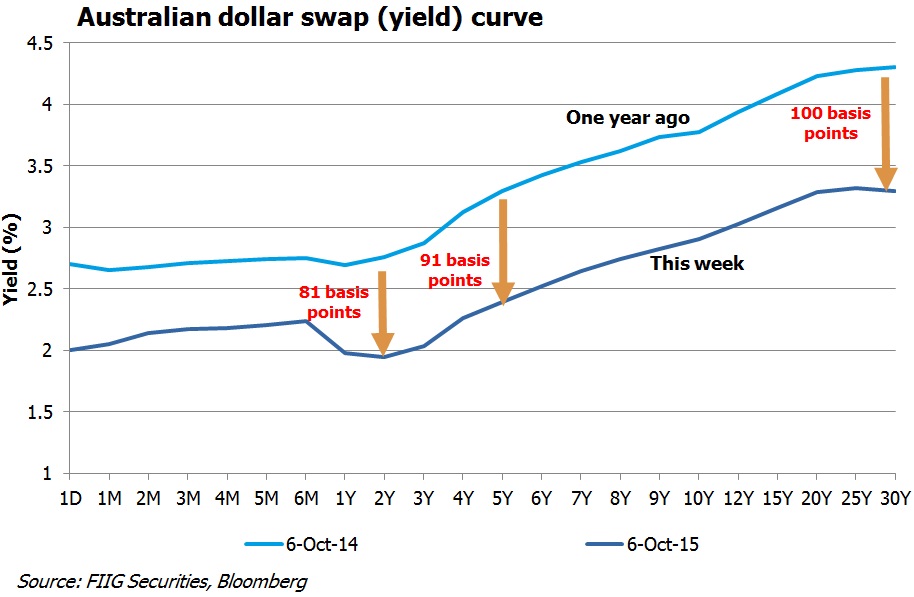

Last week, the RBA kept the cash rate steady, leaving it unchanged since May 2015. Over the last year there have been two cash rate cuts totalling 50 basis points (50 basis points = 0.50 per cent), but the yield curve has fallen by more across all maturities.

The expectation of swap in two years’ time is under 2 per cent at 1.95 per cent, a decline of a massive 0.81 per cent from its expectation at this time last year. Extending the swap maturity dates, we note that yield expectations have declined even further. The 5 year rate is down 0.91 per cent to 2.39 per cent and the very long 30 year rate is down 1.0 per cent to 3.29 per cent.

The general decline of the yield curve is known as ‘flattening’. Rates are expected to be lower for much longer. This is a blow to investors hoping for higher deposit rates as the outlook is now worse than it was a year ago.

Since the GFC, term deposit rates from the major banks have been offered at around 80 to 100 basis points over swap for a one year term, depending on their need for deposit funds. Current, attractive, one year rates are offered at 89 basis points over swap rate or around 2.80 per cent, although at different times the banks need more funds and will offer special rates. Last week Westpac were offering an attractive 3.00 per cent.

If you are looking to increase the income from your defensive assets, bonds can offer higher returns for slightly higher risk. Here are three shorter term investment grade suggestions:

- Genworth Mortgage has a subordinated floating rate bond with a call date in June 2016, when we expect it will be repaid offering a yield to call of 4.19 per cent. This is a low risk issuer, so we are comfortable with moving down the capital structure and taking on a higher risk position for the additional return.

- Southbank Tafe Brisbane, which is a senior fixed rate bond with a slightly longer term to first call of June 2018 and final maturity two years later. The return to the expected repayment date is 3.68 per cent. This issuer is not listed on the ASX nor is it a financial institution so would add to the diversification of most investors’ portfolios.

- Mirvac has a senior fixed rate bond maturing in September 2016 with a yield to maturity of 2.79 per cent. While the return is low, the bond might appeal to larger institutional investors that cannot access the same term deposit rates as retail investors.

There is also an older style over-the-counter floating rate hybrid issued by National Capital Trust, a subsidiary of NAB that has a call date of September 2016, showing a yield to call of 4.02 per cent. The higher return is compensation for the higher risk nature of the security being low in the capital structure and also the possibility that the call date will be missed and investors will then hold a perpetual security.

Note: Rates accurate as at 8 October 2015 but subject to change.