The US Federal Reserve has finally increased interest rates, being the first increase since 2006

The year-long obsession that markets and the financial media have had about when the Fed will move has now been replaced with how far they will increase rates in 2016. Wall Street economists are divided equally between another 0.5%, 0.75% and 1.00%. Our view is that the Fed will be far more patient than markets expect.

Why do we believe this?

1. The global economy is weak, with downside risks

Europe and Japan are in a multi-decade period of stagnation driven by demographic trends that cannot be reversed (aging population and low birth rates) and very high debt meaning they can’t spend their way back to a healthy economy. China is in transition from an investment (infrastructure and industrial capacity) phase into a consumer driven economy. This transition is creating pain for the economy, which is spilling over the rest of the world’s emerging and commodity driven economies (like Australia, Canada and Brazil).

The US is no longer immune to global trade slowdowns and so the Fed will be wary of raising interest rates when the global economy is fragile.

2. Currency wars rage on

Europe, Japan and China are all easing monetary policy - they are either lowering interest rates (China) or using Quantitative Easing to hold rates at zero or even below. A currency with low interest rates attracts less investment, meaning that the currency is typically sold in favour of other currencies earning higher interest. With US interest rates now higher than Europe and Japan regardless of the term, more investment will be attracted into US Dollars and out of the lower interest currencies of Europe and Japan.

The Fed will be very conscious of this currency war and the impact on the USD. If the USD rises too far, it hurts US exporters which in turn hurts the US economy. The Fed will therefore be very patient with future interest rate rises, particularly while Europe, Japan and China, are pushing their currencies down.

3. The US economy is good, but not great

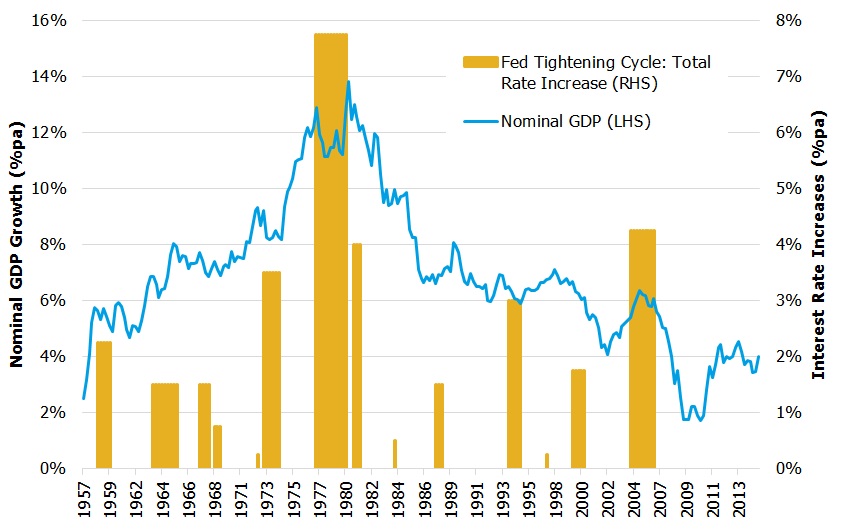

This is a very unusual time to be increasing rates. Rates haven’t been increased when nominal growth has been below 5%. The closest was in 1957, when real GDP growth was 3.1%pa and inflation 2.5%pa, compared to around 2.2%pa real growth and 2.0% inflation.

It was necessary because with rates at zero, the Fed needed to create some room to move in case their economy needs some stimulus later, that is the capacity to lower rates again. But beyond a small number of increases, the Fed is unlikely to risk damaging the US’s recovery.

US Federal Reserve tightening cycles vs Nominal GDP Growth, 1957-2015

Source: FIIG Securities, US Bureau of Labor Statistics

Reading the chart:

- The blue line represents “Nominal” GDP growth as it includes inflation, because the Fed will increase rates if either inflation rises or if real GDP growth is very high or both. But if “nominal” growth (“real” growth + inflation) is low, that means neither real growth nor inflation is high and therefore there is no cause for increasing rates, usually.

- The orange bars represent periods in which the Fed was increasing interest rates, and they end when the next decrease happens

- The higher the orange bar, the more the Fed increased interest rates in that cycle

- The wider the orange bar, the slower the rate rises took

4. Rates have rarely been increased at a time when equities and commodities markets are looking vulnerable

The only exception to this was the assault on inflation in the last 1970s, clearly shown in the chart above. Right now however, inflation is weak to mild. Equity markets are overvalued by historic measures, and earnings have been falling. Oil and other commodities have been very weak, indicating weakening demand and therefore that the economy is vulnerable to rate increases.

Investment strategy implications

Markets are now pricing in three more interest rate increases by the Fed in 2016, and for rates to rise to 2.6% over the next few years.

We believe that rates will not rise that high in this cycle, and that the ten year bond rate should therefore be priced closer to 2%pa, if not lower. We believe that the Fed will increase rates twice in 2016, taking rates to 0.75%, and then leave them there unless inflation threatens to jump well above 2.0%pa, which it is showing very little sign of at the moment. With Europe, Japan and China all weak, we remain of the view that rates will stay very low for the next decade, and that once again markets are over-confident about growth prospects and the need to increase rates.