Currency markets are driven by two very different types of investors: those looking for a safe place to park shorter term cash or low duration assets and those looking to gain from stronger economic fundamentals over the long term

Day to day currency levels will be impacted by the first, but those same investors will exit their positions very quickly when they get nervous, resulting in currency values correcting to their fundamental values. The AUD is the short term investor’s favourite because of its relatively high yield, but for how long?

Currency markets are the most liquid of all markets. They are used by investors, businesses and governments to facilitate transactions, for long term investments and for short term cash returns. Over periods of two years or more, currency levels will reflect fundamental value – the stronger an economy, the more likely that economy is to attract capital inflows either due to higher interest rates that tend to follow stronger economies, or due to more profitable/lower risk investment opportunities due to that economic strength.

But over shorter terms, currency levels are driven by completely different factors. At times of very high liquidity among investors, corporate and governments, there are trillions of dollars seeking a home that offers the best combination of capital security and yield.

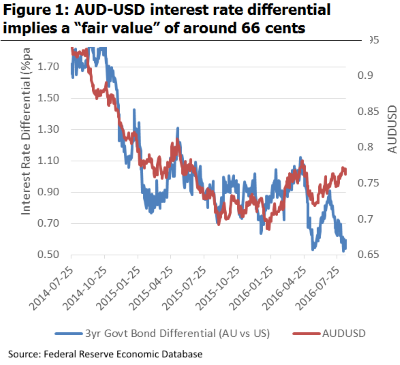

Figure 1 shows there is a very strong correlation between the AUD/USD and the interest rate differential using three year bonds as a proxy for shorter term yields. The currency has fallen as the differential has fallen, with some short term departures that have corrected after 2 to 4 months each time (see the period around August 2014 and around March 2015 as examples).

Figure 1 shows there is a very strong correlation between the AUD/USD and the interest rate differential using three year bonds as a proxy for shorter term yields. The currency has fallen as the differential has fallen, with some short term departures that have corrected after 2 to 4 months each time (see the period around August 2014 and around March 2015 as examples).

In the past three to four months we have seen another departure with the interest rate differential falling sharply, but the the AUD stubbornly holding above 75 cents.

The differential currently implying a “fair value” of 66 to 67 cents.

Short term departures from this fundamental relationship will correct very quickly

On a fundamentals basis, the Australian economy, its inflation outlook, and the headwinds it faces in terms of both the likelihood of a China slowdown and needing to transition its economy away from the mining investment boom all adds up to a fundamental value on the AUD/USD rate of under 70c, depending upon who you ask (my view remains 65 to 70c).

But for the growing global pool of cash looking for a home, particularly from sovereign and pension funds and from the faster moving hedge fund pools, Australia’s AAA credit rating combined with short term interest rates well above its G20 peers is too good to resist.

The big risk for these investors parking their cash in AUD is how fast sentiment will change if there is a concern about a sudden fall in the AUD. These investors were using the AUD for short term yield two to three years ago, and getting around 2%pa additional yield. So long as they didn’t lose more than 2%pa on a fall in the AUD, they were better off.

But now the additional yield is just 0.5%pa. At that level, the sensitivity to a fall in the currency is extreme. As a result, no investor will want to be the last one to exit their AUD positions, so the change in the currency level when it happens will be sharp, and probably even sharper than we saw in late 2014 and mid 2015 given how much lower the differential is now.

What is also different now is that it is not just about the potential for AUD rates to fall; it is now also a question of when, not if, USD rates rise. There is more upside risk on the US economy and more downside risk on the Australian economy.

Beware the flipside argument

As always, investors should consider both sides of the argument. One explanation for the recent strength of the AUD despite the lower differential is higher commodity prices. This has arguably come off the back of reduced concern about China than a few months ago and lower overall volatility. If commodity prices remain higher, Australia’s income (via terms of trade) will rise, meaning the chances of further rate cuts by the RBA will drop.

So if you are of the “China risk is coming off/ commodity prices will drift higher/ RBA won’t cut rates” camp, there is an argument that justifies a continuation of the current strength of the AUD. That’s not my view, but I’ve certainly been wrong in the past, and so always suggest investors consider both sides of every debate.

Trigger for the correction could come from GDP surprises in both the US and Australia over the next few weeks

The next GDP data out of either Australia or the US could well be trigger for investors to exit their short term AUD positions and a return to fundamental levels. US GDP is likely to surprise, looking at the data out so far, on the upside and come in at around 3.3 to 3.6% growth (annualised), compared to the market consensus of 2.5%.

Australian GDP may stay strong, but the more relevant Gross National Income measure is likely to be less than 1.0%pa growth, reflected in the steep fall in construction activity released this week.

If there is both an upside surprise on US GDP and a downside surprise on Australian growth, the interest rate differential could fall much further, or at least cause more fear of the differential falling further, sending the AUD lower.