As published in The Australian on 7 February 2017

Government bonds have been on the nose since Trump sent bond prices lower last year on the promise of tax cuts and increased spending – but the underlying corporate bond market continues full steam ahead

Government bonds have been on the nose since Trump sent bond prices lower last year on the promise of tax cuts and increased spending.

But the underlying corporate bond market continues full steam ahead, with demand massively outstripping supply. So much so that blue chip, AAA rated technology giant, Microsoft was able to get the year’s biggest bond transaction just a few days ago. It raised US$17 billion to refinance commercial paper used to fund the acquisition of LinkedIn and fund general corporate purposes, including share buybacks and capital expenses.

Despite the size of the transaction, some investors were left empty handed with demand rumoured at US$38 billion.

Our domestic corporate bond market mirrors that of the US in that demand far exceeds supply. Consequently, bonds prices are rising and expected returns compressing. New investors may have to wait for reluctant sellers before they can access the bonds they want.

Typically, I would suggest to new investors should expect to earn 1 to 2 percent per annum more than deposits for a low risk, investment grade bond portfolio, putting the expected yield at between 3.8 and 4.8 percent per annum. Not terribly exciting, but there are ways to improve returns for those willing to accept higher risk.

One of the strategies we favour at the moment for wholesale investors is tapping the US high yield market where returns can be as high as 10 percent per annum. The US high yield corporate bond market is huge – worth approximately US$1.4 trillion of a total corporate market of about US$8.5 trillion. Issues sizes are usually large and provide good trading liquidity. Many companies issuing bonds are listed, with good news flow and visibility over market capitalisation. Our analysts particularly like those sectors with physical assets such as telecommunication and power generation.

If Trump succeeds in his proposed stimulus measures, both of these sectors are likely to benefit from improving business conditions.

An example of a corporate bond we like is McDermott International, a global engineering, procurement, construction and installation business providing services for upstream oil and gas developments. They have a fixed rate bond due to mature in May 2021 that has a current yield to maturity of just less than 6 percent per annum. The US$100 face value bond traded as low as UD$63.50 in February 2016, but has rebounded and now trading at around US$104.50. The fluctuation reflected the company’s exposure to oil prices, which dropped circa 75 percent over the same period. These bonds may be quite volatile but as long as the company continues to operate, investors can expect a return of $100 face value at maturity. For this company, volatility is somewhat mitigated by a strong backlog of work worth US$3.9 billion as at 30 September 2016.

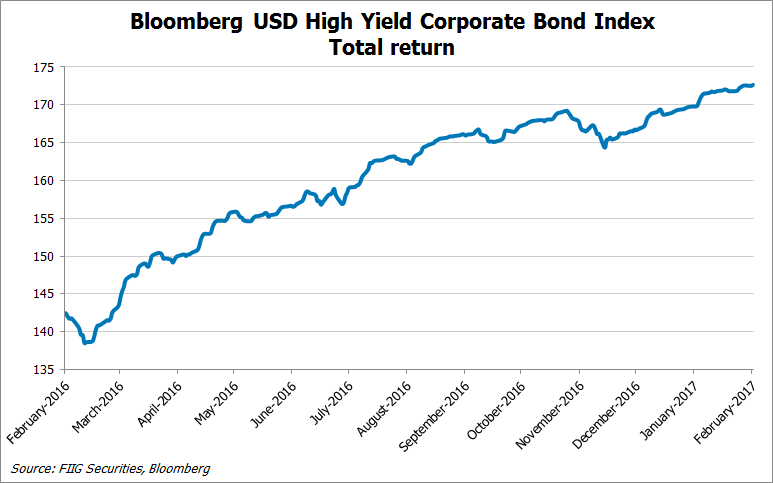

The stellar move in the McDermott bonds along with others exposed to commodities – helps explain the 21.17 percent return in the Bloomberg USD High Yield Corporate Bond Index last year.

There are significant risks involved in investing in the US high yield bond market including currency and interest rate risk. However, as much of the return is a margin for credit risk, that is the possibility of the company not being able to pay interest or return capital at maturity, changes in interest rates are less likely to impact the price of the bonds, compared to government bonds that just reflect changes in interest rates.

Government bond yields are a benchmark and the rising US 10 year yield has largely been mimicked by the Australian government 10 year yields on an upwards trajectory. Both bonds have moved up by roughly 1 per cent from 2016 lows to 1.46 per cent for the US and 2.72 for the Australian bond. It’s worth remembering that the yields convey what the markets expect and will not necessarily eventuate.

Even though these benchmarks have moved higher, global demand for corporate bonds has pushed the spread over the benchmarks down, lowering overall corporate bond returns. This is illustrated by the Bloomberg USD High Yield Corporate Bond Index, up 21.17 percent in 2016, up 1.61 percent to December 2016, averaging 5.13 per cent over the last three years.

The US high yield bond market presents more choice and potentially more depth than the Australian market but if anticipating volatility, timing of entry and name picking are key.

The domestic corporate bond market is under developed and I expect many Australian companies to continue to issue in US dollars where they can access larger volumes and often at better yields than what can be achieved in Australia.