There are significant advantages derived through investment in bank bonds issued by Australian Authorised Deposit-taking Institutions (ADIs) over the alternative of holding surplus cash in At Call accounts and/or investing in Term Deposits (TDs).

This paper showcases the advantages of bank bond floating rate notes (FRNs) however the discussion can apply equally to fixed rate bank bonds. Bank bond FRNs are chosen because many investors choose to roll cash and TDs in short maturities given the significant price implications of having to break longer maturing TDs in the event of required liquidity (refer Appendix 1). However, if longer maturing TDs are the benchmark, a portfolio of fixed rate bank bonds with similar characteristics of TDs can also be proven to outperform for the same reasons.

| Advantages of Bank Bond FRNs | Risks |

- Excess yield

- Immediate liquidity

- Low credit margin volatility

- Price transparency via daily valuation

- Exposure diversity opportunity

| - Adverse credit margin change leading to asset devaluation

This risk can be quantified as the amount the credit margin can widen before a TD outperforms an FRN |

ADVANTAGES OF BANK BOND FRNs

EXCESS YIELD: ADIs raise a significant volume of wholesale funds by issuing bonds in a variety of structures and maturity ranges (refer to Appendix 2). Given the volume of capital required to fund their operations, and their requirement to match asset and liability terms, banks reward investors in these products with a significant credit margin above benchmark bank bill, cash and TD rates. For investing in longer dated bank bond FRNs, thereby taking term to maturity risk, investors can expect an annual yield advantage over TDs of up to:

| Yield Advantage of a Bank Bond (FRN) Portfolios over TDs |

| TD + 0.85% | TD + 1.38% | TD + 1.90% |

| Senior Only

5-year Bank Bond (FRN) Portfolio | 50% Senior & 50% Subordinated

5-year Bank Bond (FRN) Portfolio | Subordinated Only

5-year Bank Bond (FRN) Portfolio |

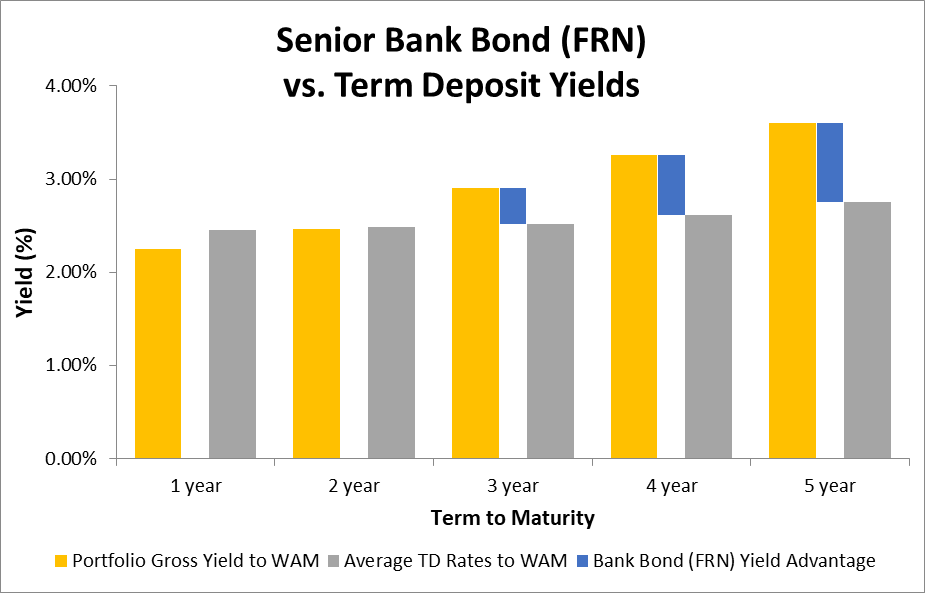

The yield advantage of bank bond (FRNs) over TDs and cash commences and builds significantly beyond the 3 year maturity range

LIQUIDITY: Most senior bank bond FRNs as issued by ADIs are classified as High Quality Liquid Assets (HQLA) by the Reserve Bank of Australia. These (and other ADI-issued bonds) are extremely liquid and can often be sold immediately. This is unlike TDs which cannot be terminated prior to maturity without a significant penalty and at least 30 days advanced notice (refer to break costs table in Appendix 1).

LOW VOLATILITY: Bank bond FRNs have historically exhibited a low volatility of credit margin change in all periods of financial market history excluding the GFC (refer to Appendix 4). They are positioned high in the capital structure and are highly-rated, investment grade assets. The MIPS Portfolio Management Team (PMT) retain a historically positive credit opinion of this asset class, even more so now given recent regulatory enforcement of capital standards by the Australia Prudential Regulation Authority (APRA).

PRICE TRANSPARENCY: Assets are valued daily by leading independent valuation agencies. Valuations are a function of all market transactions in the asset class with all various market participants contributing all trade data to the agencies.

DIVERSITY: Australian banks continually issue bonds ranked senior or subordinated, with either fixed or floating coupons (income payments) in varying maturities across the yield curve, providing investors with the opportunity to diversity their exposure as best fits their requirements. Investing in fixed rate products introduces duration risk, but this risk is equivalent for TDs of the same maturity. Income payments for fixed rate notes will be the same over the life of the bond and are known up front. The income payment that an investor will receive for investing in an FRN will be a function of the coupon margin (set on issue date) added to the forward Bank Bill Swap Reference Rate (BBSW) which is reset each quarter. Estimates of the forward BBSW and therefore future expected income payments are outlined in Appendix 3.

RISKS ASSOCIATED WITH BANK BOND FRNs

ADVERSE CREDIT MARGIN CHANGE: Whilst investors can expect a yield advantage, it is a reward for taking term to maturity risk. The risk borne is the possibility of price deterioration (or credit margin widening) which is a function of the market devaluing a bank’s creditworthiness. The yield advantage derived for investors exposed to a portfolio of bank bond FRNs allows for sizable credit margin deterioration over the first year of holding and still breaks even against holding TDs of a similar maturity. The advantage becomes significant at and beyond the 3-year maturity range as evidenced in the table below. Additionally, an investor who elects to extend exposure to a 3-year portfolio consisting of 50% senior and 50% subordinated bank bond FRNs, can afford a credit margin deterioration of near 40bps and still break even against similar maturing TDs.

| Weighted Average Term to Maturity (WAM) | 1 year | 2 year | 3 year | 4 year | 5 year |

| Senior Bank Bond FRN Average Credit Margin to WAM | 30bps | 50bps | 80bps | 90bps | 115bps |

| Senior Bank Bond FRN Portfolio Gross Yield to WAM | 2.25% | 2.52% | 2.90% | 3.26% | 3.60% |

| Average Term Deposit Rates to WAM | 2.45% | 2.48% | 2.52% | 2.62% | 2.75% |

| Break Even Credit Margin Loss per Annum | | 0.04% | 0.20% | 0.22% | 0.23% |

PERFORMANCE

| Performance History and Looking Ahead for the

MIPS Bank Bond 3 (BB3) Investment Program comprised of

50% Senior & 50% Subordinated FRNs issued by Major Australian banks |

| Actual return 3.85% gross annually | Expecting to return 3.31% gross annually |

| 1st September 2015 to 1st March 2018 | MIPS estimate for the next 3 years given credit margins have narrowed recently (see Appendix 4) |

SUMMARY

The MIPS Portfolio Management Team (PMT) manages exposure for investment mandates that invest across fixed and floating rate products, and favours maintaining a short duration exposure across all portfolios given the estimate of future interest rate direction. Further discussion regarding the MIPS PMT investment strategy can be found in the latest MIPS Quarterly Report.

Within the bank bond sector, the MIPS PMT can construct a portfolio as per the investor’s credit, cash flow, maturity and liquidity requirements. For those clients currently rolling short maturity cash and TDs, the MIPS PMT recommend deriving improved yield by complementing their existing strategy with a MIPS Bank Bond FRN program. For those clients who wish to lock in fixed rates, the MIPS PMT can also replicate these portfolios in fixed format.

Notes

A bank bond FRN portfolio managed by the MIPS Portfolio Team is available to Australian wholesale investors with a minimum investment of $5,000,000.

GLOSSARY

The Bank Bill Swap Reference Rate (BBSW) is the definitive market average cost of borrowing by banks and therefore the yield earned by investors for maturities of between 1 and 6 months. It is published daily and referenced by all FRN structures to determine quarterly coupon ratesets.

The Interest Rate Swap (IRS) curve is, in any country including Australia, the benchmark source of determination of both fixed and floating rate yields and forward floating rate yields.

APPENDICES

Appendix 1: Term deposit early prepayment penalty table

Appendix 2: NAB 5-year $2bn issued on 18 September 2018

This issue size is regularly replicated by all Australian Major Banks. In 2017 alone, in excess of $500bn of senior FRNs was issued.

FRNs product design is homogenous and subsequently credit margin pricing between banks for similar maturity dates is very similar.

Appendix 3: The Interest Rate Swap Curve, forward BBSW & predicted forward ratesets for an example Bank Bond FRN 4-year Portfolio

Appendix 4: Historical volatility of major bank senior & subordinated floating rate notes