Switch US high yield Talen into USD investment grade Adani Abbott Point

Chris Thomas – Melbourne (03) 8668 8844

Chris Thomas – Melbourne (03) 8668 8844

S&P recently downgraded Talen from Stable to Negative. The bond prices have been quite volatile over the last 18 months and I think it could be a good time to switch out of Talen and into USD Adani.

The USD Adani Abbott Point bonds are offering 2%pa higher return than the Australian dollar denominated bonds, which I see as an opportunity. Highlights of the opportunity based on a circa USD250,000 Talen face value include:

- Decrease face value exposure from USD250,000 to USD200,000

- Improved credit rating by four notches

- Shorten maturity profile by 2.5 years to December 2022

The yield on the Adani bonds is significantly lower yet in excess of 7%, compared to approximately 12.5%pa for Talen, highlighting the perceived risk differential. Both of these bonds are for wholesale investors only.

Source: FIIG Securities

New Australian dollar investment grade – AT&T

Ben Taylor – Sydney (02) 9697 8731

Recently, US telecommunications giant AT&T successfully executed its 10 year fixed rate Aussie dollar bond issuance and it is now trading in the secondary market. The company is massive with a market cap of USD242bn and revenues of USD158bn in the last twelve months.

The AT&T offer looks attractive from a relative value perspective and is rated investment grade. Our third party research provider has a stable credit and relative value opinion on the company and the outlook for the company is stable. AT&T continues to delever which is helped by free cash flow generation of over USD15bn.

For investors looking to purchase investment grade opportunities, while securing a long term cash flow, this new AT&T bond looks attractive especially coming to clients below par.

Please see indicative pricing below for wholesale investors only.

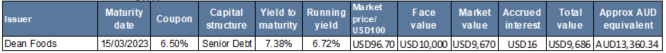

US high yield bond - Dean Foods

Jake Koundakjian – Brisbane (07) 3321 6629

Who is Dean Foods?

NYSE Listed Dean Foods (NYSE:DF) is a leading food and beverage company in the USA and is the largest processor and distributor of milk and various other dairy products in the US. Its strong brands include DairyPure (branded white milk), Friendly’s (Ice Cream) and Tru-Moo (flavoured milk). DF does have some challenges from NAFTA, where there are current barriers preventing US supply of milk into Canada, as well as excess supply of fluid milk in Canada. Additionally, there has been a decline in milk consumption in the US which is in conjunction with a consumer trend towards nut and plant based milk. However, DF is meeting these challenges by shifting its focus to cost cutting and increasing productivity. This seems to be working as evidenced by its improved free cash flow, despite a decline in operating income and gross profit.

Rationale for investors

Our independent credit research provider has a positive credit and relative value opinion on DF’s bonds. While DF may face loss of volume from declining milk consumption and competition from other major players like Walmart and Food Lion, they expect the company to maintain reasonably low leverage – in the range of 2-3 times by year end. Consequently, our credit research provider believes “the 7% yield on the 2023s is compensation for the risk in the name”. Wholesale qualified FIIG investors can find a link to the latest external report on DF below. We also note the company is focused on its balance sheet management with the net debt leverage at 2.67-times Bank EBITDA as shown in the graph below.

Highlights of the Bond:

- Yield 7.375%

- Running Yield 6.72%

- Rated sub investment grade

- Senior unsecured

- Buying under par @ USD96.70

- Minimum USD10,000

Note: This bond needs a W8Ben form to invest.

Note: This bond needs a W8Ben form to invest.

Please note this bond is callable early at higher levels, which if called early would be a great win (~USD103)

Clean price since December 2017

Source: Bloomberg, FIIG, Reuters

Click here to read the research article

Company Website

Note: Pricing accurate as at 25 September 2018 but subject to change.

If you have any questions, please call your local dealer or 1800 01 01 81.