A high 0.7% quarterly inflation rate was announced today so we thought it would be appropriate to highlight inflation linked bonds (ILBs) and the value they offer in a fixed income portfolio. Here we include some inflation strategies

There are three questions we will consider:

- Why are inflation linked bonds an important constituent of a balanced fixed income portfolio?

- Why is this an opportune time to buy them?

- How can investors balance income and capital growth with an inflation linked bond strategy?

1. Why are inflation linked bonds an important constituent of a balanced fixed income portfolio?

Fixed and floating rate bonds can offset the risk and return features of each other well. When interest rates are falling, the diminishing income from floating rate notes can be offset by the fixed return (and potential capital gain) in fixed rate bonds. Conversely, in a rising interest rate environment, the falling market valuation of fixed rate bonds can be offset by the higher income realised in the floating rate bonds.

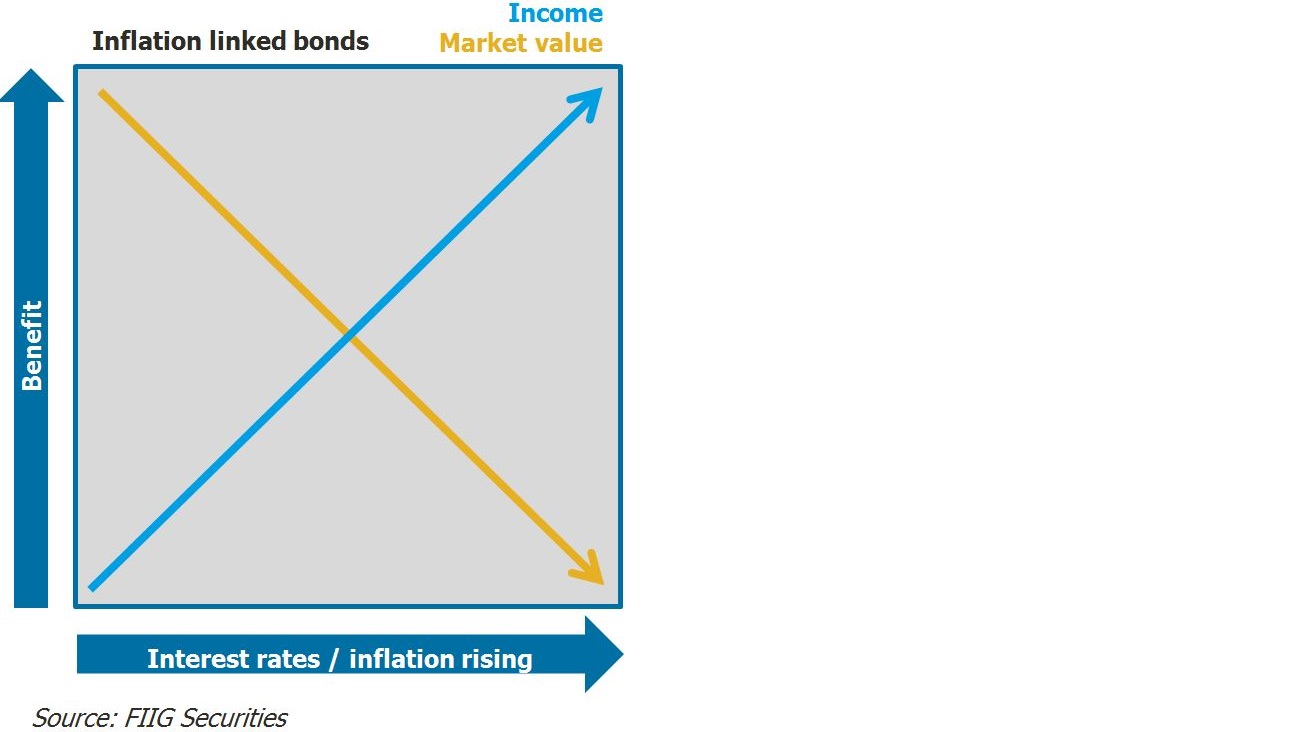

Figure 1

Inflation linked bonds contain elements of risk and return that parallel, to a certain extent, the features of fixed and floating rate bonds in a single security. Using the broad assumption that falling inflation is accompanied by falling interest rates and vice versa (because interest rates are used to regulate inflation), one would expect income and market valuations to move in different directions in these investments, offsetting one another. This is because in a falling interest rate environment inflation – and the bonds’ inflation linked income - would be falling. In contrast, the market valuation would be rising due to the falling rates (the net present value of the projected cashflows would be greater).

Conversely, in a rising interest rate environment, the market valuation of an ILB would be falling, but income would be rising.

Figure 2

Figure 2

2. Why is this an opportune time to buy inflation linked bonds?

There are two factors that make now a compelling time to add to an inflation linked bond portfolio:

1. The recent abrupt rise in longer term interest rates. Figure 3 below shows the long term trend in the ten-year swap rate. The recent rise began in April and was the sharpest correction since June 2013, when talk of quantitative easing (QE) ending in the US caused a panic about the potential implications. The more recent panic was similarly around the US Federal Open Market Committee (FOMC) moving toward raising rates for the first time since 2006. As in 2013, the panic about a higher interest rate environment is very likely to be proven wrong, particularly in Australia, where commodity prices and an uncertain Chinese economic outlook will undoubtedly keep a cap on growth over the medium term.

Figure 3

The effect of this rise in longer term interest rates has been that market prices for longer term bonds, including ILBs, has fallen significantly in a very short time. These bonds can now be accessed for yields not seen since late December 2014.

2. Today’s inflation figure. Inflation rose last quarter by 0.7% - equating to an annualised figure of 2.8% - which is the figure used when calculating inflation for inflation linked bonds. However, another inflation measure, the “Trimmed Mean” is the one targeted and monitored by the Reserve Bank of Australia (RBA). This was lower at 0.6%, and the year-on-year equivalent at 2.2% is well within the 2%-3% band. This means that the indexed value of ILBs will enjoy a healthy increase this quarter, even though the Trimmed Mean figure was at the lower end of the RBA band.

3. How can investors balance income and capital growth in an inflation linked bond strategy?

This is a topic on which I have written in the past in the article, How to get what you need from inflation linked bonds and which was very well received, so it is well worth revisiting here.

There are basically two ends of the spectrum in terms of requirements when considering inflation linked bonds in a portfolio, with most investors falling somewhere in the middle.

The first is maximum inflation protection for your capital. This investor wants to assure the value of the invested dollar increases with the rate of inflation, with the maturing value reflecting the accumulated effect of inflation, and the ongoing income from the investment secondary to this consideration. This investor is typically an SMSF in accumulation phase.

The second is to maximise cashflows over the term of the investment, increasing along with the rate of inflation, and the maturing value of the investment is secondary. This investor is typically an SMSF in pension phase.

The most common types of inflation linked bonds in the Australian market are Capital Indexed Bonds (CIBs) and Indexed Annuity Bonds (IABs). The nature of these products makes them more suitable for some strategies and less so for others, as we will discover. It is important that investors recognise their reasons for investing in these securities and choose the right strategy for that goal.

Capital Indexed Bonds (CIBs)

CIBs generally pay a relatively low interest payment, and the principal value grows along with the rate of inflation. Interest is paid based on the growing face value of the principal, and at maturity the final lump sum value is repaid to the investor. The effect of this is twofold:

- Interest increases each quarter by the rate of inflation, but the payments are generally lower than other fixed income investments.

- The value of the bond increases each quarter by the rate of inflation, returning a greater amount of cash at maturity or sale of the bond.

CIBs generally suit investors who are seeking maximum inflation protection for their capital, and are particularly attractive when the bond is purchased at a discount to its face value. Figure 4 shows the expected cashflows and value of the principal on the Sydney Airport 2030 CIB assuming an initial investment of approximately $60,000.

Figure 4

Note: We assume inflation is 2.5% per annum but could be higher or lower than this amount, impacting returns.

Indexed Annuity Bonds (IABs)

Indexed Annuity Bonds have a predetermined pay down schedule, much like a mortgage, but with an additional factor in that each (quarterly) payment increases by the rate of inflation. This allows the inflation effect on the principal to be realised along the way, but leaves no principal value remaining at maturity.

IABs generally suit investors who are seeking greater inflation adjusted cashflows over the term of the bond, and those cashflows are greater for shorter term bonds (as with any other annuity). Figure 5 shows the cashflows and value of the principal on the Novacare 2033 IAB.

Figure 5

As a simple example of how these securities can be combined, Figure 6 shows combinations of the two bonds that achieve the following results:

- Invested value of approximately $60,000

- Maturing principal value of approximately $60,000

- Cashflows that more closely match normal fixed income cashflows, with the additional benefit of rising with inflation

Figure 6

In this example where we have combined the CIB and the IAB, the initial cashflow generated per annum is around 4.55% of the invested value, more in line with a typical fixed income investment, and increases each quarter along with inflation. This is similar to a floating rate note, whose income fluctuates with short term interest rates, with one important difference: as long as inflation is positive, the cashflow level is floored at the current level each quarter. So while the income on a floating rate note can increase and subsequently decrease as interest rates rise and fall, the cashflow on these inflation linked product combinations will always rise unless inflation turns negative. In this example, the projected cashflow generated in 2033 has risen to around 6.60% of the original invested value.

With the two Sydney Airport CIBs (and a handful of others when available) and with over 10 IABs to choose from, there are many portfolio combinations than can be constructed to achieve the best balance of cashflow and capital protection to suit your needs.

For more information and please call your FIIG representative who can model various combinations to suit your specific needs.