By Justin McCarthy and Craig Swanger

Concerned about China? We have constructed a ‘Short China’ portfolio for investors worried about a downturn in the Chinese economy

Following on from the article China's woes hit the Australian dollar, oil and equities but boost bonds and gold, we thought it may be useful to reproduce the ‘Short China’ portfolio that we ran in a recent seminar series of example portfolios for various economic scenarios.

Investors are increasingly asking about China and what a downturn or ‘hard landing’ would mean for the Australian and world economies. Whilst we will leave it to investors to make up their own minds if this will occur, below are some key charts and strategies for a ‘Short China’ bond portfolio that would be expected to outperform in such a scenario.

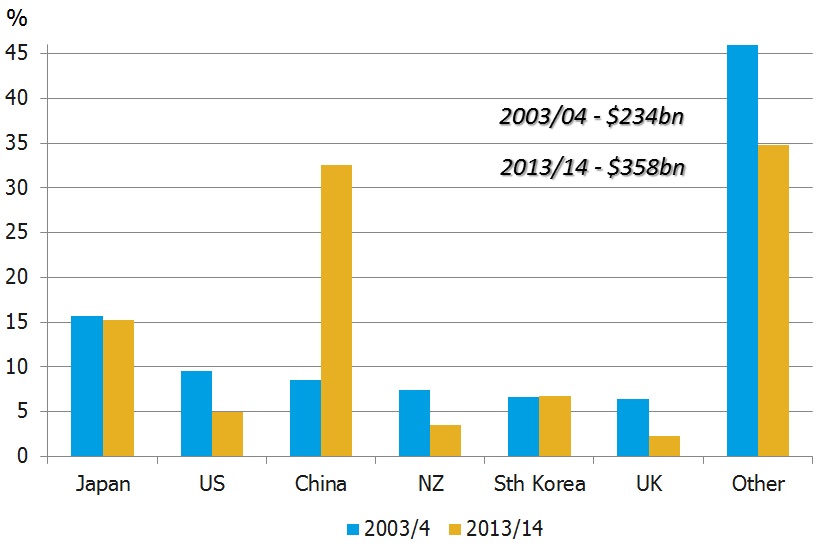

Australia is the most China-dependent country in the world. Exports to China now make up 6% of Australia’s total GDP and a whopping 32.5% of total exports. This is up from just over 8% ten years earlier, with the increased reliance on China coming at the expense of exports to USA, New Zealand and the United Kingdom (see chart below).

Australian exports by value

The graph depicts Australian exports for the period 2003/4 and 2013/14, demonstrating in particular the dramatic increase in exports to China over the past decade.

The graph depicts Australian exports for the period 2003/4 and 2013/14, demonstrating in particular the dramatic increase in exports to China over the past decade.

Source: FIIG Securities, ABS

The table below details the suggested strategies for various asset classes for a downturn in China or ‘hard landing’.

Asset allocation strategy

| Strategy | Rationale |

| Short AUD | The AUD is a proxy currency for China GDP growth. As Chinese growth falls, so too would the AUD. Given the dependency on exports to China, interest rates would be cut by the RBA to stimulate domestic growth to offset the fall in exports. The selloff in FX markets would be sharp. |

|

Reduce equities and replace with high quality credit risk

|

Australian equities would be severely hit; but all equity markets will fall on a China downturn. Credit/bond exposure enables returns to be maintained without downside risk.

|

| Reduce exposure to exporters | Mining stocks and any other company with large China-exposure; such as education and construction.

|

|

Increase inflation hedges

|

Interest rates will come down in this environment so long duration bonds will outperform, unless inflation breaks out. Some inflation hedging (via inflation linked bonds) should accompany long duration portfolios.

|

Source: FIIG Securities

Detailed below is a ‘Short China’ portfolio that would be expected to outperform in such an environment. It is centred around a high allocation to low-risk fixed rate bonds, essential infrastructure bonds (many with inflation linked income streams) and a diversified allocation to foreign currency bonds.

Other key benefits include:

- Profit from falling AUD and falling interest rates

- Maintain investment income

- Infrastructure and RMBS allow corporate earnings exposure

- Very low Australian economic exposure

- Well diversified

'Short China' portfolio

Please note this portfolio is available to wholesale investors only. Rates are indicative only, pricing is accurate as at 17 August but subject to change.

*Inflation linked bonds, IAB and CIBs assume inflation averages 2.5% for life of the bond.

**The earliest date was chosen for call/maturity date as an assumption.

Source: FIIG Securities

'Short China' portfolio by Ratings, Currency and Bond type

The pie charts above show the break down of percentage exposure to: rating, currency and bond type, in the 'Short China' portfolio.

Source: FIIG Securities

For more information, please speak to your FIIG representative.