In a low inflationary environment, it is easy to discount the value of protecting against future inflation. On the other hand, now is a good time to lock in an inflation hedge because the cost is low. If inflation takes off, prices will increase sharply.

While the risk of inflation may seem low at the moment, it is possible that the global experiment in Quantitative Easing (QE), or “printing money” in order to stave off deflation risks, could overshoot, resulting in excess inflation in the medium term.

The market’s benign expectations for Australian inflation have been reinforced by the most recent Consumer Price Index (CPI) data, which showed that consumer prices increased less than expected in the last three months of 2014 with a rise of 1.7% in the headline inflation rate. This was just below economists' expectations of a 1.8% rise year-on-year and a sharp slowdown from the 2.3% increase reported for the preceding quarter. However, underlying inflation, which strips out the effects of extreme price movements at either end of the scale, actually came in stronger than economists were expecting, rising 0.7% in the December quarter for an annual rate of 2.25%.

So what about inflation in the longer term? The European Central Bank (ECB) and Bank of Japan (BoJ) are both using QE specifically to battle deflation, so there is a risk of them “over-succeeding” and creating global inflation.

Beyond 2015, there is a risk of inflation breaking out in Australia, compliments of the global QE experiment and impact of the falling AUD on import prices. The reality of QE is that it is an experiment. Economic theory, for what that is worth, tells us that adding liquidity to the economy or “printing money” increases inflation, as seen in Germany in the 1930s. Both the ECB and BoJ are attempting to increase inflation to stave off deflation risks. What if they succeed and global inflation spikes?

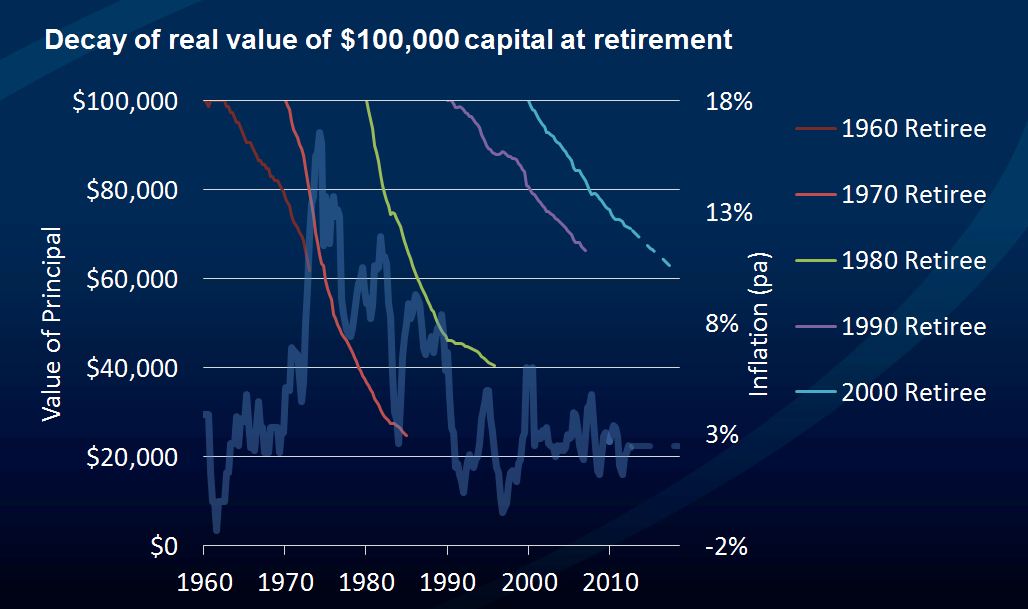

Inflation is an important consideration when assessing investment options, with the real return (or return after inflation) of most relevance to investors. Figure 1 below illustrates the effect of inflation on $100,000 of capital for investors who retired at decade intervals between 1960 and 2000 (calculated with the rates of inflation during those times). For example, a person who retired in 2000 would find the value of $100,000 of principal would now be worth about $60,000 in real terms.

Figure 1

Figure 1

Source: FIIG Securities

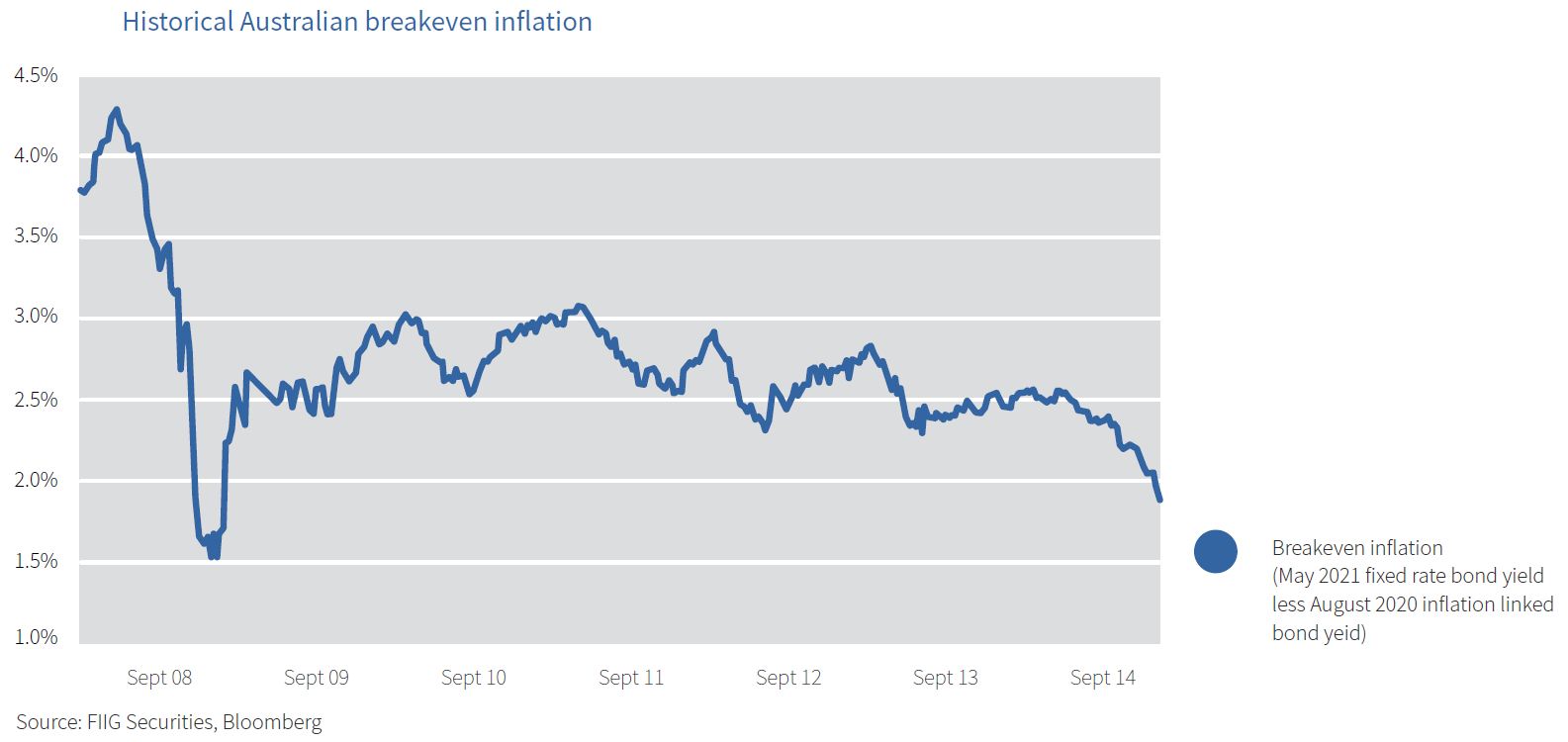

Looking ahead, the market is forecasting and pricing in inflation of less than 2% p.a. on average until 2020 (see Figure 2). Therefore, currently it is very cheap to buy inflation protection. Investors may wish to take this opportunity to protect against the threat of an inflation outbreak driven by central banks’ QE experiment. You can do this by buying inflation linked bonds while the market is pricing these securities cheaply.

Figure 2

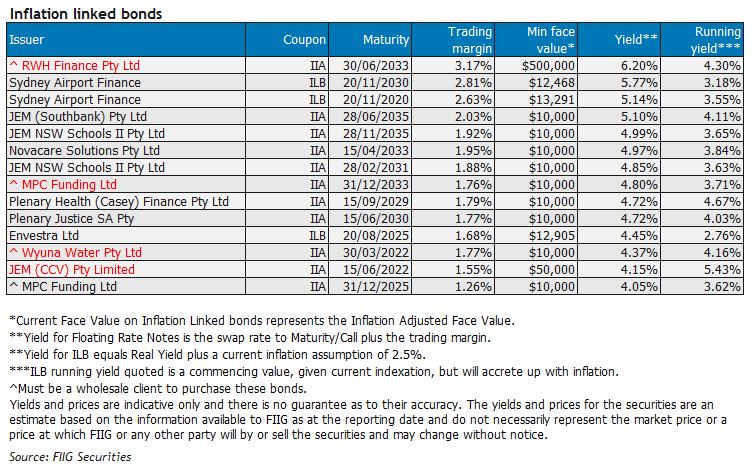

There are a range of inflation linked bonds (ILBs), both capital indexed and annuity style. Below is an example of some ILBs in order of highest to lowest yield. Please note that these are indicative offers only. Please contact your FIIG dealer for more information.