Well – we saw volatility return to markets in late 2019 and it has certainly been rammed home with the impact of the coronavirus being felt across the globe.

Underlying slowing of global macro conditions has been brought right to the forefront of all people’s views, not just investors, as the virus (at least in the short term) is proving to be a catalyst that returns some sort of rationality to markets, if not to the projections of the epidemiological progress of the disease based on incomplete at best, and manipulated at worst, data.

The review period for the portfolio is to the end of February, and most of the violence in bond markets was reserved for the first week in March when the US Federal Reserve did an out-of-meeting emergency cut for the first time since the GFC, reducing its cash rate by 0.50% on the 3rd of March.

Yield curves had already moved significantly lower in the last week of February, as huge equity volatility – the quickest 10% drop in the S&P500 in history – had bonds pricing in much lower yields across all tenors.

The flipside to lower rates is that investors become nervous as risk assets whipsaw around. We saw this with credit spreads (the extra return over the risk-free rate) widening in high yield by about 1.20%, which clearly affects the high yield portion of the portfolio.

The AUD is a global risk on currency. It’s also often used as a proxy for China investment given it reflects our local economy being so tied to China’s, and being a currency, is also a very liquid way to play this trade. As such when risk is sold off, the AUD typically falls.

This is one of the core principles underpinning the construction of this portfolio, and so it was nice to see this in action, as the AUD dropped from the 0.68 level at the end of December to just above 0.65 by the end of February.

This natural hedge is imperfect, and at times will run in front of or behind the movement in the USD bond prices, but in the long run I believe it will substantially cushion any overall downward movement in underlying USD high yield bond prices.

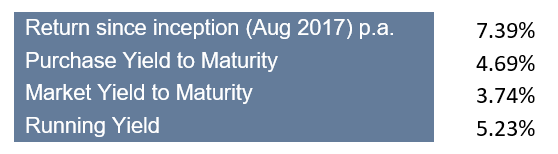

The fall in rates, widening in spreads and fall in the AUD all worked together to deliver a nice uptick in overall performance to 7.39% p.a. since inception. The internal checks and hedges of the portfolio seem to be working nicely to maintain steady performance.

Trading wrap:

Given the moves in markets, mostly I was watching and waiting to see if any opportunity presented itself.

By the end of February, the only thing to do was to sell the Virgin 2024 USD bond before the virus really hit the fan. Fortunately I did this before the week of equity sell-off and so escaped the worst of the damage. I held the cash in USD as the next opportunity from any dislocation will come in the US high yield market, and with my bearish view on the currency I didn’t want to be exposed to a currency move.

The opportunities presented themselves in the first week of March – I appreciate that is outside the review period for the portfolio but shows how quickly things can move, and I wanted readers to be aware of what is happening now.

In that week I sold the QTC 2033 bond for the equivalent maturity government bond. Spreads on semi government bonds have started to widen – just a little – and I prefer to have the pure interest rate exposure at this stage rather than the slight credit risk of QTC. This equates to marginal gains but remember, this is a bond portfolio not an equity one.

I have also used the Virgin cash to buy the Peabody 2022 bond, which for a senior secured 2-year maturity looks very cheap at a yield to maturity of 12.3%.

Outlook:

I am holding approximately 5% of the portfolio in cash in case something else pops up and I don’t have immediate liquidity on the day, as I want to be able to be opportunistic.

I don’t think we are at the point where I will offload the government bonds, as yields can go lower from here – there is lots of talk of QE and that will be a great time to look at how much I can make from those govvies.

So much from here depends on the path of the coronavirus as it makes its way across the globe, and more importantly the impact it will have on both supply and demand.

Monetary policy can help economies but it can’t make people travel or go to work if they are sick or frightened of getting so. To be fair, US Fed Chair Powell said as much in his press conference after the rate cut.

There could be more pain to come and opportunities to capture, so I will be watching closely and be ready to act, either on the sell or buy side.

Earn over 6% pa*

with Corporate Bonds

Superior returns with fixed income certainty

Find out more