We compare the results of IAG, QBE and Suncorp and conclude with some investment recommendations.

Key points:

- IAG and to a lesser extent Suncorp reported good results. QBE reported an annual loss after troubles in the US business.

- The capital position of all three is sound, with prescribed capital amount ratios (PCA) of 1.68x for IAG, 1.59x for QBE and 1.96x for Suncorp

- The AUD callable subordinated debt and Tier 1 insurance securities are generally viewed as fair value or expensive, particularly the AUD Vero 2016 call (and other domestic Vero issues). The non-AUD issues are superior value, especially the USD QBE 6.797% Tier 1 (+478bps), GBP IAG 5.625% subordinated debt (+245bps) and GBP Suncorp Insurance 6.25% subordinated debt (+312bps) issues

- IAG propose to issue a new A$300m subordinated bond in the near future and it’s worth watching the market as it may offer a buying opportunity

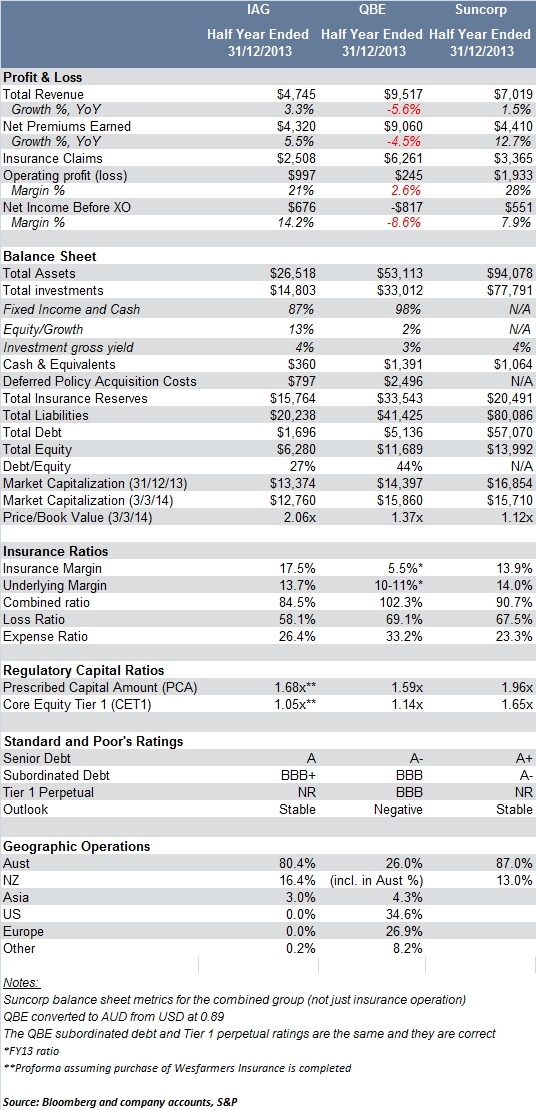

The three big insurers in Australia; IAG, QBE and Suncorp, have all released their results in recent weeks. The following table details the most recent half year results (to 31 December 2013), as well as a number of other comparison metrics:

Table 1

Issues to note include:

- IAG and Suncorp are essentially operating in Australia and NZ, with only very small operations in other countries. By comparison, QBE has far more international exposure with only 26% of premiums relating to Australia and NZ

- Insurance conditions in Australia and NZ have been favourable in recent times, whereas QBE has been hit by large payouts and goodwill writedowns in its US operation which is responsible for much of the recent underperformance. The QBE Australian operation has performed far better than the US operation

- By most measures, IAG is currently the best performing of the three big insurers with higher profitability and insurance ratios

- The short term outlook for IAG and Suncorp are relatively favourable, whereas QBE still has some issues to deal with in its offshore operations

- All three have relatively conservative investment portfolios with the vast majority invested in cash and fixed income. However QBE’s investments are shorter in duration and heavily weighted to (low yielding) USD bonds, which has resulted in lower returns over recent years

- From a capital perspective, Suncorp is the strongest with a very high PCA of 1.96x and additional support of the overall Suncorp Group if required. This is reflected in the higher credit rating. All three are considered to be well capitalised with PCA of 1.68x for IAG and 1.59x for QBE

- QBE is roughly double the size of IAG with the Suncorp Insurance Division between the two on the basis of net premiums earned and balance sheet size

Relative value assessment

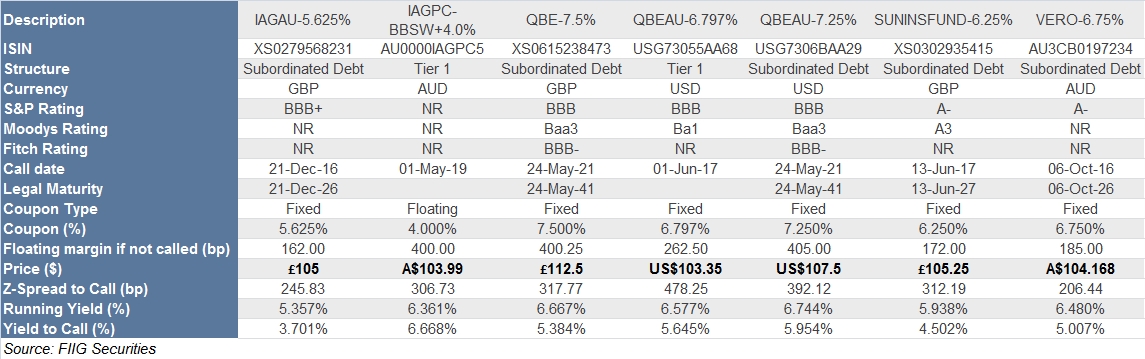

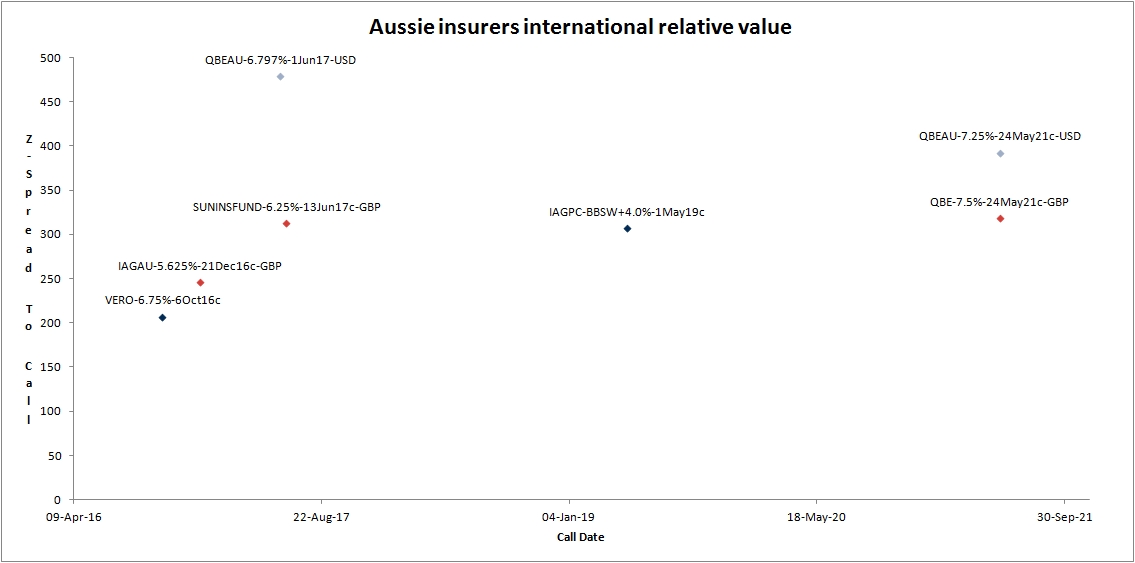

Table 2 and Figure 1 detail the available bonds from these three insurers in various currencies. As we are looking across various currencies, the most appropriate figure to consider is the “Z-spread” which is similar to the trading margin but adjusts for differences in currencies and swap curves.

Note that all the issues are subordinated debt except for the IAGPC, which is a “new-style” ASX listed AUD Tier 1 perpetual (mandatory converting) issue and the QBE 6.797% which is an Tier 1 perpetual “old-style” step-up USD.

Table 2

Figure 1

The AUD callable subordinated debt and Tier 1 insurance securities are generally viewed as fair value or expensive, particularly the AUD Vero 2016 call (and other domestic Vero issues).

As is often the case, the non-AUD issues trading in offshore markets are superior value due to the lack of familiarity of those names in international markets. In particular, the following three bonds are seen as attractive:

- USD QBE 6.797% Tier 1, callable 1 June 2017 (z-spread +478bps). As an “old-style” step-up we expect it to be called, as has been the case with all QBE’s past step-up securities. At a very high trading margin, and yield to call of over 6.5% in USD, it is viewed as a very high yielding bond

- GBP IAG 5.625% subordinated debt, callable 21 December 2016 (z-spread +245bps). Given the strong position of IAG credit and near term outlook, this is viewed as far superior value to the much riskier ASX listed “new-style” Tier 1 perpetual security which has a z-spread of just 61bps more and an extra 3 years to first call/conversion date

- GBP Suncorp Insurance 6.25% subordinated debt, callable 13 June 2017 (+312bps). With a stronger credit profile than IAG and only 6 months longer to first call, the extra 67bps in z-spread is considered excellent relative value

According to the recent IAG results presentation, the company proposes to issue a new AUD $300m subordinated bond in the near future and this may present a buying opportunity, particularly for those not wanting to invest in foreign currencies.

Conclusion

All three of the large Australian insurers are well capitalised and relatively strong credits by international comparison.

While the Australian insurance market has seen favourable conditions of late, QBE’s performance has lagged IAG and Suncorp due to problems with its offshore operations. IAG is currently the best performing of the three but Suncorp has the strongest balance sheet.

From a relative value perspective, wholesale investors can diversify their holdings into non-AUD securities and significantly increase trading margins (z-spreads). Investments can be done on an unhedged basis if investors want to take a position on a certain currency or it is also possible to hedge some or all of the currency risk with the help of your bank.

According to the recent IAG results presentation, the company proposes to issue a new AUD $300m subordinated bond in the near future and this may present a buying opportunity.

All prices and yields are a guide only and subject to market availability. FIIG does not make a market in these securities. All securities mentioned are only available to wholesale investors from a minimum of £50,000.