So far in this series, we have looked at credit ratings (here) and FIIG-originated unrated primary issues (here).

In this edition we will look at primary deals in the wider market, which are public deals and follow a different process to FIIG-originated deals.

Market new issues are, in the very conservative and institution-driven Australian bond market, typically led by one of the major banks, either solely or as part of a group of Joint Lead Managers (JLMs) representing the issuer in the capital markets.

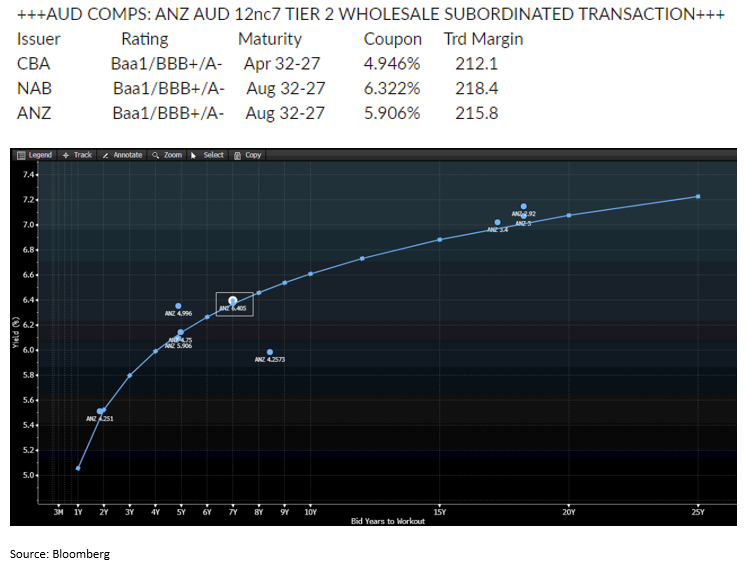

The Debt Capital Markets (DCM) team of the bank will have a number of comparable bonds to look at when looking at pricing a new bond. These could be other bonds from the same issuer, with different maturities and therefore creating a ‘curve’ against which the new bond can be compared, or similar issuers either at the ratings level or in the same sector. These will typically have similar maturities so as to mitigate any differences in tenor when comparing different issuers.

For example, for the ANZ Group subordinated bond priced on the 13th of September, the comparables were the below existing bonds from similar issues, creating the curve off which the new bond could be fitted:

Bond documentation drives whether or not the particular bond is available to wholesale or retail investors, either at primary issue or later in the secondary market.

If the documentation allows, the primary issue is usually reserved for wholesale investors, but it can become available to retail investors after it has completed a 12-month ‘seasoning’ period.

The trend over the last few years in particular has been for the documentation to prohibit ownership by retail investors, so the range of bonds available to them has shrunk as existing bonds have matured. This is one of the main benefits of being a wholesale investor – the range of bonds to choose from encompasses the whole market, whereas the retail stock is declining as time passes and new bonds are not eligible, while existing bonds are redeemed.

Market new issues also historically deliver one of the best entry points into a bond investment, all other things being equal. This is because the issuer needs to incentivise investors to participate in the new bond issue rather than hold existing bonds or buy a different bond in the secondary market.

This leads to the existence of a ‘new issue premium’, which is extra return provided to investors in a primary issue as the incentive. We examined this premium and the subsequent deterioration in time post the issue date in this article here.

Typically market primary issues are priced and allocated via a bookbuild process, where bids are taken by the Joint Lead Managers (JLMs) at varying amounts and price levels, before the deal is closed and pricing is finalised.

An investor’s allocation is then finalised based on demand and the size of the issue desired by the issuer. In recent times there has been significant oversubscription for most if not all deals issued in the market, resulting in investors bidding being scaled, in other words receiving less than their bid amount.

Given the new issue premium seems to remain for up to 30days post issue, topping up allocations as soon as possible is likely to deliver the best result.

So, in conclusion, primary issues in the wider market typically offer a premium to secondary issues and are accessed by bidding into a bookbuild process. Scaling can occur and pricing may also change until the deal is closed, but this uncertainty can be mitigated by placing orders at a limit and/or topping up under-allocations in the secondary market as soon as possible.