Now is a good time to invest in bonds. If you only have one or two bonds, we suggest here a few more you could add, whether you’re a retail or wholesale investor. We also briefly describe the benefits of a bond portfolio and our new online ordering system

There may be a whole range of reasons that you only own one bond but, regardless of why, it is not healthy for your portfolio. It exacerbates the portfolio’s risk as you only have exposure to one company, one sector, one type of bond and one maturity date.

The last few years have generally been good for bond investors and it may be that your bond has outperformed, delivering a higher than expected return. It’s worth checking its current status to see if there’s something better to switch into or whether you should add some more bonds to your portfolio.

If you’ve held your bond for a while, you may be unaware that you can add to your portfolio or transact from as little as $10,000.

Benefits of a bond portfolio

- Diversification

One of the key benefits of fixed income is the diversification it can bring to your portfolio. A single bond is better than no bonds at all but a portfolio of five bonds or more is even better. So, if you have some spare cash sitting around or you have a term deposit that matures soon, it’s worth considering adding more bonds to your portfolio.

There are many companies that issue bonds and some that aren’t listed on the ASX. For example, monopoly Queensland coal port, Dalrymple Bay Coal Terminal. This is an infrastructure asset and some of the bonds are quite short, maturing in just 12 months in June 2016, while others are longer dated, maturing in six years in June 2021 or 11 years in June 2026.

Both of the longer dated bonds are floating rate, meaning they will capture any expected increases in interest rates by increasing the income you receive.

Infrastructure investments are great in retirement providing defined income over long terms.

- Cover your portfolio for any economic climate

If you hold just one bond, then you have only covered one of the fixed, floating and inflation linked options available. Ideally, you would have an allocation to all three types of bonds. Fixed rate bonds give you certainty of income, floating rate bonds protect your portfolio if the market expects higher interest rates and inflation linked bonds are linked to the Consumer Price Index, so protect your purchasing power.

- Better returns than term deposits

Corporate bonds will provide higher returns than term deposits for slightly higher risk and current returns range from 4% to 8%.

- Bonds available in $10,000 parcels

FIIG has been at the forefront of making wholesale bonds available in smaller parcels to both retail and wholesale investors. You can now hold a portfolio of five bonds of $10,000 per bond. So if your single holding is $50,000 or more, you could sell down part of your holding to diversify into other bonds.

Some bonds to consider

- Retail - low risk, investment grade

One of the ways to get higher returns on low risk companies is by investing for longer terms. Three of the bonds below are for more than five years. The Sydney Airport inflation linked bond on the list below has a very long maturity date. But, it’s important to remember that bonds are tradeable and you don’t have to hold them until maturity.

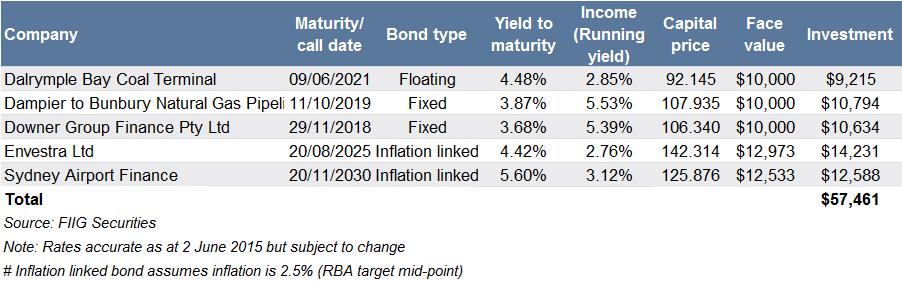

If you wanted to buy all of the bonds shown, the overall statistics of the portfolio are shown below. The weighted average yield to maturity shows the expected return on the bonds if they were all held until maturity. The running yield or income is what you could expect to earn in the next 12 months.

2. Retail - high yield

Four of the bonds on this list were originated by FIIG and offer high returns given higher risk when compared to investment grade bonds. All four have call dates, when the company can choose to repay investors, so you’ll see some additional columns in this table. These are the first call date, being the earliest date the company can opt to repay bondholders, and the yield to first call which is the expected return if you hold the bond to that first call date.

3. Wholesale

There’s a mix of bonds on this list. Three are investment grade, with the Rabobank bond being the lowest risk, followed by Royal Women’s Hospital and Adani Abbot Point. The Qantas bond is the only one of the three Qantas bonds on issue that remains available to wholesale investors only. It offers almost 5% until maturity in six years and remains good value if you think interest rates will be lower for a long time. Dicker Data, 360 Capital and Moneytech are non-rated FIIG originated bonds.

Trade online

There’s no need to call a FIIG dealer to transact any more. If you already own a bond and have an account with us, you can use our new online trading service.

In just a couple of months we’ve had over 50 clients place instructions online for almost 100 transactions.

If you are keen to try the system, follow the process below:

- Log on to My FIIG, go to the ‘Bonds’ tab and see the featured offers. This is a list of the recently traded bonds by all clients and includes a link to the research.

- If you click on the issuer’s name, this will bring up more specific details about the bond. You can click on the PDF for a full factsheet.

- Click on the ‘Buy Request’ button, or view the model portfolio, which you can buy as well.

- You can always use the search function to find bonds not shown on the page.

- Buying bonds is as simple as clicking on the ‘Buy Request’ button. The bonds are added to your shopping cart, which you can view at any time.

- If you want to sell bonds you need to go to click on the ‘Portfolio’ tab to see the list of the bonds you hold, then click on the ‘Sell Request’ button. Your current portfolio is the only place where you can lodge a sell request. You’ll need to type how much you want to sell (in $10,000 lots) and add the request.

- Once you’ve made all of your buy and sell requests, click on the ‘Checkout’ button. On this summary page you can review, edit, delete and submit your orders. Prices shown are indicative only.

- Read the terms and conditions and tick the box, then submit your request.

- You’ll then receive a pop up note thanking you for the order. Your relationship manager will be sent an email with the request and call you within a day to confirm the order.

Finally, you can keep track of progress by opening the request page. Multiple orders can be at different stages, partly filled, filled and awaiting settlement.

Need more help?

- If you need a refresher course in bonds, you can register for our next Introduction to Fixed Income Webinar on 18 June, by clicking here

- Try reconnecting with your dealer. If you can’t remember their name just call our general office number on 1800 01 01 81