A step by step guide of the basic process ratings agencies apply, using the recently issued Pepper Residential Securities Trust No. 12 as an example, showing the substantial amounts of housing market stress that even sub-investment grade RMBS are designed to withstand.

Credit ratings provide a useful comparison when comparing fixed income products, however, it is important to step past the simplistic final grading and understand what a credit rating actually means.

Moreover, with structured financial products like Residential Mortgage Backed Securities (RMBS) often trading at wide premiums to equivalently rated corporate paper, to understand their quality and potential relative value, we need to examine what their ratings are telling us.

This article will step you through the basic process ratings agencies apply, using the recently issued Pepper Residential Securities Trust No. 12 as an example, showing the substantial amounts of housing market stress that even sub-investment grade RMBS are designed to withstand.

How do the ratings agencies assess RMBS?

At the heart of RMBS structures are a pool of mortgages. Accordingly, in its simplest form, the maximum amount of loss that an RMBS structure can experience is equal to the proportion of these mortgages which default, multiplied by the average loss on each property when sold.

Because of this, the ratings agencies define a level of housing market stress to correspond to each rating level and see what level of foreclosures and losses a given pool of mortgages would expect to experience.

In order to do this, they:

- Define the expected losses that a standard portfolio would suffer under each rating’s corresponding level of housing market stress.

- Compare how the mortgage pool for this RMBS structure differs from the standard portfolio, and adjust the expected foreclosure frequencies and loss severities accordingly.

What are the levels of stress?

To establish the levels of stress associated with each rating, the ratings agencies make assumptions about a standard portfolio of loans. These assumptions relate to borrowers’ credit histories, property and loan characteristics and past performance. Then by analysing historical levels of losses for similar loans, they derive expected performance under stress scenarios.

Table One shows the expected levels of stress and resulting losses that would arise for an individual loan under each of Standard and Poor’s ratings:

This table makes it clear how tough these ratings are, with a AAA rating designed to be able to withstand a 45% drop in market values, and even a B rating being designed to withstand a 30% drop.

How do they adjust for different mortgage pools?

The standard mortgage portfolio is quite idealised and, in reality, most mortgage pools underlying RMBS structures differ from them a lot. Accordingly, the ratings agencies adjust their expected default frequencies and costs of sale for each loan depending on its characteristics.

For example, by observing that the likelihood of default is strongly correlated with a mortgage’s loan to value ratio (LVR, or the percentage of the value of the property which has been borrowed), they alter their expectations depending on each loan as shown in table two. Note that the standard portfolio consists of mortgages with an LVR of 75%; accordingly, its adjustment factor is flat.

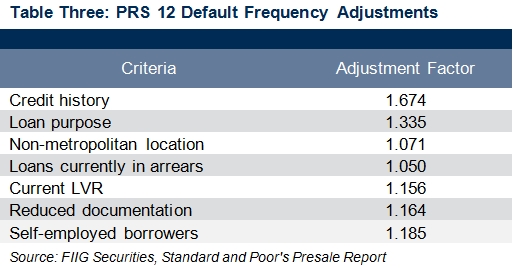

They continue this process for each of the characteristics of loans in the standard portfolio (some affecting default frequency, some affecting costs of sale) and aggregate the adjustments.

For example, in the recently issued Pepper Residential Securities Trust No. 12 (PRS 12), Standard and Poor’s applied the adjustments shown below in table three.

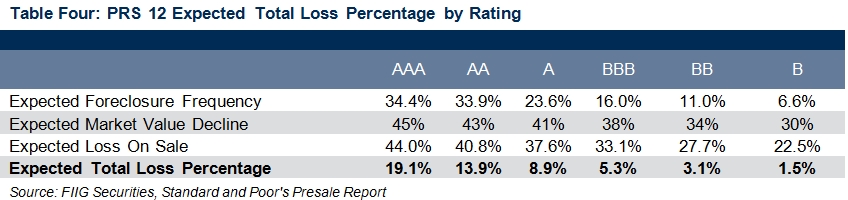

By aggregating the changes in table three, table four shows the final expected loss levels for PRS 12’s pool of mortgages at each rating.

By aggregating the changes in table three, table four shows the final expected loss levels for PRS 12’s pool of mortgages at each rating.

How do they rate each tranche?

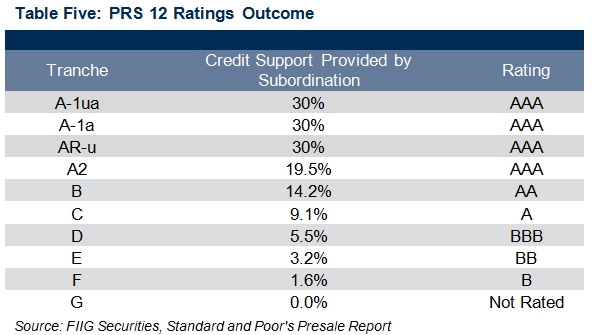

RMBS consist of a pool of mortgages which service a tiered liability structure, whereby investors at the bottom earn a higher rate of interest in return for absorbing losses resulting from the mortgages first. This serves to protect investors at the top of the structure. How much of a pool’s losses are felt by investors depends on where they sit in the capital structure.

Ratings agencies look at the expected loss percentage for each rating level and compare this to the amount of support investors in each tranche have underneath them. For example, table five shows the ratings outcomes for PRS 12.

Conclusion

Ratings provide a tool for easy comparisons between different “credits”, however it’s often difficult to identify exactly what they mean. One of the useful things about RMBS is that by virtue of their clearly defined underlying asset pools, we can tell exactly what a rating means.

For RMBS, AAA isn’t just an obscure designation: it means that a security can be expected to withstand a 45% market value decline for each of the underlying mortgages. Further, because the adjustment factors are defined so declaratively, if you disagree with any of the assumptions, it’s easy to adjust them for yourself and develop your own view.

Given the poor performance of some RMBS structures in the United States in recent years, we believe that since recalibrating their models in 2011 and 2012, RMBS ratings in Australia are very conservative. Moreover, given the considerable market value declines that predicate even a single ‘B’ rating level of stress, the ratings process further highlights the robustness of RMBS as a defensive asset class.