I think there are 4 major things impacting macro at the moment. I will go through each of them with my views and some charts that I think offer some information. I don’t necessarily agree with technical analysis but others definitely do and it does have the potential to move markets. Smart people who have been successful traders and investors use them so it would be very unenlightened to dismiss them out of hand.

US Election

The first thing to say is I don’t want to get into personal choices about the options – I’m concerned with the market reaction as it pertains to our investments.

Why is this important? To be honest, either of the choices are going to let go some pretty big fiscal stimulus, but it is all relative. The extremes on either end would have been a Trump win, Republican Senate and more Republican House to the more conservative end and the “Blue Wave” of the Democrats in all 3 positions at the other end, which is basically what the market was pricing in.

The likely outcome now with Biden as President is the middle ground of a Democrat President, a Republican Senate and a more Republican House. The absence of a strong mandate in either direction is likely to result in somewhat of a rudderless term with little ability to affect a lot of change.

The stock market has liked this to some extent, but you can still see in the narrative in the media over the weekend that they are searching for positives where in my opinion few exist – such as Biden being a long term politician likely to work better with other long term politicians such as McConnell. Given the polarisation of the arguments over the last 4 years I think this is some wishful thinking.

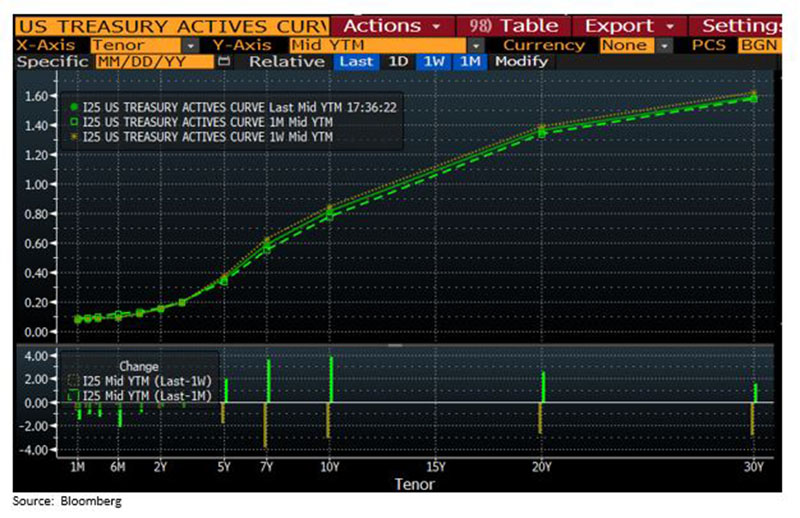

The bond market reflected the positioning for the blue wave, having steepened (longer term yields higher vs shorter term yields) in the anticipation of a larger stimulus package under the Democrats and therefore massive issuance of US Treasuries to fund it.

In addition, most of the fiscal stimulus to date has been funded with short term bills – bonds with less than a year to maturity – and so those will have to be refinanced over the next few months as they come to maturity. This is expected to be at the longer end of the curve as it becomes clear that the borrowing will need to extend for years.

From April to June the US Treasury borrowed US$2.753 trillion and from July to September it borrowed US$454 billion and for Jan to March 2021 they expect to borrow another US$1.127 trillion. Astonishing numbers, although the next quarter is likely to be lower as mentioned above.

The impact on the market as I said has been lower longer term yields, although still higher than 1 month ago. It is relatively marginal but when you are talking about a trillion here and a trillion there, a few bps in yield makes a difference to the budget.

USD

As the world’s reserve currency, what happens to the USD affects all global asset classes. Of particular interest to the macro picture is how the relative strength of a nations’ currency can import inflation or deflation.

For us, as RBA Governor Lowe remarked last Tuesday when he announced the lowering of interest rates, the currency is a driver of inflation domestically given we are a small, open, capital importing economy, and as such if our currency is stronger than it should be, we typically see lower inflation through a reduced price of imported goods.

In a similar way if the USD remains strong, there is lower inflation in the US.

This is a complicated arrangement for the US at the moment as they have been redesigning their relationship with China, with one of the main focuses being the trade imbalance. Of course this runs on many levels, but the US under Trump labelled the Chinese government as a currency manipulator as they fix the level of the offshore yuan vs the USD.

A weaker yuan means their exports are relatively more attractive – this has been played to perfection by the Germans in the EU currency union, as the Euro reflects a considerably lower foreign exchange rate environment for the Germans than if they were an independent nation. This isn’t something that has sat well with the US under the Trump presidency.

With the huge fiscal deficits and the expectation of more under Biden, the USD has got weaker on a trade weighted basis since the onset of COVID, although part of the complexity in trying to forecast the direction of the USD is that under Trump’s first deficit funded spending programs the USD weakened and then strengthened – it seems the size is the key factor and it needs to be more than $2 trillion now to weaken the currency!!!

For me the deficit seems to be the major influence on dollar weakness. I am sceptical that we can suddenly find a vaccine for a coronavirus given we haven’t been able to do so for the rest of human history but I guess that’s what breakthroughs are all about. It is pretty well balanced…

Deutsche Bank came out on the 10th saying they were re-establishing their USD short recommendation on the vaccine news – which makes no sense to me – as the advent of as vaccine opens up the economy, which in turn means less stimulus required, lower deficits and a stronger USD. However, they seem to have the opposite view based on Trump, meaning uncertainty and that kept the dollar strong even though they acknowledge with the divided President/Senate/House Biden won’t be able to pass huge deficit spending (which means smaller deficits again). I guess we will agree to disagree…

Race to the bottom in rates

With the stimulus measures having been put in place around the globe, interest rates are basically at or below zero in every economy that counts. Sorry Turkey but your 14% overnight rate isn’t attractive…

Foreign exchange has been the great balancer as this has played out, with the USD being the main casualty as the chart above shows, although savers might also reasonably be considered to have been ambushed as well.

The interesting thing for me is that the main themes that have been in place for some years – demographics and deflation (mainly due to technology) – are still in place. The pandemic has in fact even accelerated the technological side of things, with working from home being a huge example of a previous perk now being mainstream. We still have no real way to predict what the longer-term ramifications will be. Would you want to return to a 1-2 hour commute when it has been forced upon your employer that you can do the job just as well without it, and perhaps be even more productive given the better work-life balance?

These thematics are in my opinion likely to keep inflation low, and with the propensity for banks to tighten lending standards as we are hearing anecdotally and seeing in the data (as below from the St. Louis Federal Reserve – this is the same for all loan types), economic activity remains well below where it was pre-COVID, given lending is the lubricant of business.

This means low growth, low inflation and low rates, for even longer as we have to grow out of the impacts of the COVID lockdowns which have been the worst since the Great Depression – this will take years given how over-indebted the world is. I’ve shared this thesis from Lacy Hunt of Hoisington before.

COVID

I wrote the majority of this piece on Monday the 9th before the vaccine news – yields went up a lot on this news overnight on the 9th/10th, around 15bps, which I think is a bit nonsensical given the infection rate in the US and EU and a northern hemisphere winter to come before any likelihood of it being rolled out… We since have had a pullback and yields are now broadly where they were before the news.

I think the broad macro picture is still in place but the insolvency phase of the pandemic might be avoided if the liquidity can tide businesses over for another 12 months – and that’s if the vaccine actually does work and can be delivered to the whole world – and that’s a big if….

An effective vaccine will of course be a game changer, but I am sceptical that one that’s meaningfully effective can be found, but I hope it can. Unfortunately for the short term even Pfizer said it will be 6 months before their announced vaccine gets through testing and is available at a meaningful scale. We have the northern hemisphere winter to get through first and it doesn’t look good. Below is the US and Europe is pretty similar.

Most of the major European economies are in some form of lockdown and this is likely to get worse before it gets better.

That to me implies lower bond yields until at least March, and that is also a long period for a lack of stimulus. The EU stimulus to date has been insufficient given they are so hamstrung by their cash rates already well below zero and the reluctance of the richer states to burden their balance sheets. Germany came to the party more than expected but others haven’t so much and the weaker economies such as Italy simply don’t have the firepower available.

The US is hamstrung politically now and we may even not see confirmation of Biden as President until December or later if Trump decides to fight in the courts.

All of this makes me concerned of a worse than otherwise COVID winter season, which may well tip business over the edge – mainly small businesses as large businesses with access to the capital markets will be fine for liquidity, even if their balance sheets will be worse for it.

Conclusion

If the vaccine works and can be produced in sufficient quantities to make it generally efficacious, then that will be a great thing from a human point of view.

That will deal with the virus, however we will still be in a world of poor demographics, even lower interest rates and higher debt, which restrains economic growth. Remember that debt is consumption today at the expense of consumption tomorrow.

The only way out is growth and inflation, and as I mentioned above, inflation is nowhere to be seen. Growth has just been given the biggest hit for over a century.

All of this leads to lower rates, which is why I think you need to be optimising your portfolio as much as possible to get the most from your credit spreads, and particularly domestically with the RBA embarking on QE, I am not afraid of longer dated exposures. Of course it has to be measured and I wouldn’t be buying the 30 year government bond, but good credits with decent margins will serve you well, and occasionally an obvious one comes along like LendLease which should be jumped all over even soon after issue if primary is not successful.

The nuanced view is the currency. There is no doubt the RBA would like to see it lower, but if China is on a positive track then it is likely we will see appreciation given how much the AUD is used as a liquid, legally stable proxy for China.

I do think however that the cat is out of the bag in terms of the retreat of globalisation. Companies have realised that governments care not when the chips are down for their supply chains, and national security is not just found at the end of a gun barrel or an aircraft carrier (though they of course do help!!). The US has just realised that >90% of its antibiotics are manufactured in a hostile nation and this could be a problem.

If nothing else Trump began this process which is one that I think will be continued, which inevitably will reverse the process of cost cutting by offshoring, and that will be bad for corporate profits.

As one of the guys I respect in the macro game has said for years, “Buy bonds, wear diamonds”.