Key points:

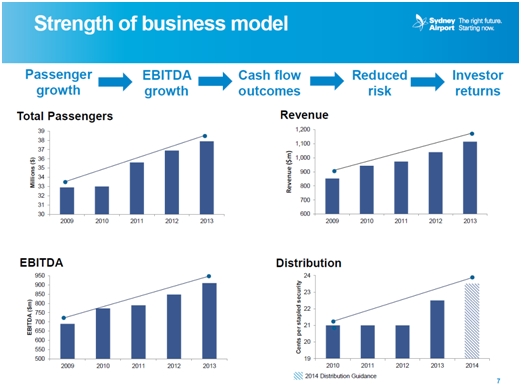

- Ongoing growth in passenger numbers, revenue and EBITDA. Acquisition of minority shareholdings provides improved transparency of results.

- Government approval of the new 2033 Masterplan which shows how the airport will manage an increase in passenger numbers from 38m to 74m passengers per year.

- Sydney Airport 2030 remains the highest margin investment grade inflation linked bond available.

Last week Sydney Airport reported its full year results to 31 December 2013 with solid growth across all key metrics including passenger numbers, revenues and EBITDA. This is a continuation of five periods of year-on-year growth as the airport continues to go from strength to strength.

Source: Sydney Airport Full Year Results presentation

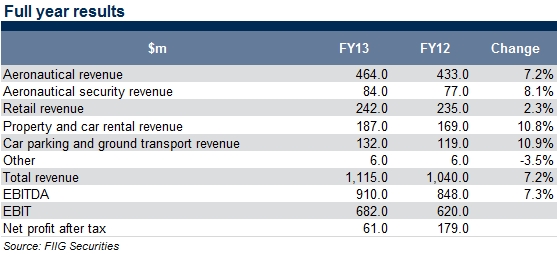

The company reported strong growth across all of its key businesses with total revenue of $1.12bn, up from $1.04bn in the prior year. EBITDA grew 7.3% to $910m (from $848m) on the back of solid growth in international customers (up 4.1% on the prior year). The airport continues to see strong growth in passenger number from both China and India, a trend which is expected to continue into the future underpinning continued financial performance improvements.

The company also achieved a number of operational outcomes during the year including the completion of the 2033 Master Plan which plots the airports capacity growth from its current 38m passengers to 74m passengers by the end of 2033. The company also cleaned up its ownership structure, buying out the minority shareholders so that going forward, investors should enjoy more financial performance transparency with the ASX listed entity (SYD:AX) financial accounts aligned with airports performance (previously the ASX listed entity held minority holdings in other airports, which had to be accounted for).

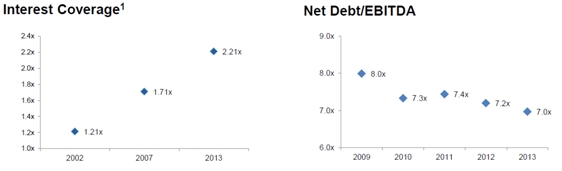

The company continued to improve credit metrics and its debt profit retains a well diversified set of maturities. With significant undrawn facilities and managements history of rolling over debt prior to maturity we remain confident in the security of Sydney Airport bonds for our investors.

Source: Sydney Airport Full Year Results presentation

Source: Sydney Airport Full Year Results presentation Sydney Airport’s Inflation Linked Bonds (ILBs) continue to offer the strongest returns in the ILB market and continue to be a core recommendation from FIIG Securities for investors fixed income portfolios. The Sydney Airport 2020 ILB is offering a yield to maturity of 6.15%* and the 2030 ILBs, for those with a longer horizon are offering a yield of 7.00%*, the best return of any investment grade ILB in the market.

* Yield to maturity based on a long term inflation average of 2.5%.

The Sydney Airport inflation linked bonds are available to retail and wholesale investors from $10,000 face value. For more information, please call your local dealer.