Latest production report review - challenges remain

The quarterly result and improved guidance is positive for the company and demonstrates its continued resilience in the face of a falling iron ore price. However, the company continues to remain exposed to further sustained falls in the iron ore price, which seems to be the general market consensus.

Following the quarterly report release last week, Moody's downgraded Fortescue Metals Group Ltd's corporate family rating to Ba2 from Ba1. At the same time Moody's has downgraded FMG Resources (August 2006) Pty Ltd's senior unsecured rating to Ba3 from Ba2, and has placed a negative outlook on the company’s ratings.

All of the Fortescue bonds have rallied on the news, but if there are further falls in iron ore to the low $40’s per dry metric tonne (dmt) and below, the rally may be temporary in the absence of other measures such as debt reduction, asset sales or balance sheet management. We expect the positive quarterly report will drive positive sentiment back to the company as long as iron ore price hovers around $50/dmt or increases. However, given the high volatility in iron ore prices we will continue to see a high degree of volatility in the longer dated (2019 and 2022) bond prices.

On the assumption of a medium term USD35/tonne iron ore price, which has now been suggested by some investment banks, the outlook for Fortescue remains cautious in the absence of further news in relation to the company’s balance sheet position. Even with the company improving its FY16 breakeven guidance to USD39/dmt, Fortescue would be running at a loss at this price. If a USD35 iron ore price forecast does eventuate over the medium term, then the recent rally may be provide an opportunity to exit ahead of even lower bond prices based on continued falls in the iron ore price.

However, if the revised iron ore forecasts have overshot the mark and iron ore prices have found their low point around the $50/dmt level, then the company has a few more years available to work out a debt solution. In this kind of scenario, the later dated Fortescue bonds (particularly the 2019s) look like good value at double-digit yields to maturity, but investors should be aware of the potential downside risks related to iron ore in the current environment.

March quarter highlights

- Cash is up from USD1.6bn at 31 December 2014 to USD1.8bn through positive cash margins achieved in the March quarter

- Shipments for the quarter were 40.4 million tonnes, in line with expected production of 160 million tonnes per annum

- The company realised a price of USD48/dmt on its iron ore shipments, based on an average contract price of USD55/dmt, in line with the 85%-90% price realisation guidance

- Direct production (C1) costs in the March quarter of USD25.90/wmt are in line with previous guidance

- Net debt at 31 March 2015 was USD7.4 billion has remained steady, with finance leases of USD0.5 billion (inclusive of the recently commissioned USD140 million finance lease on Fortescue River Gas pipeline) and cash on hand of USD1.8 billion

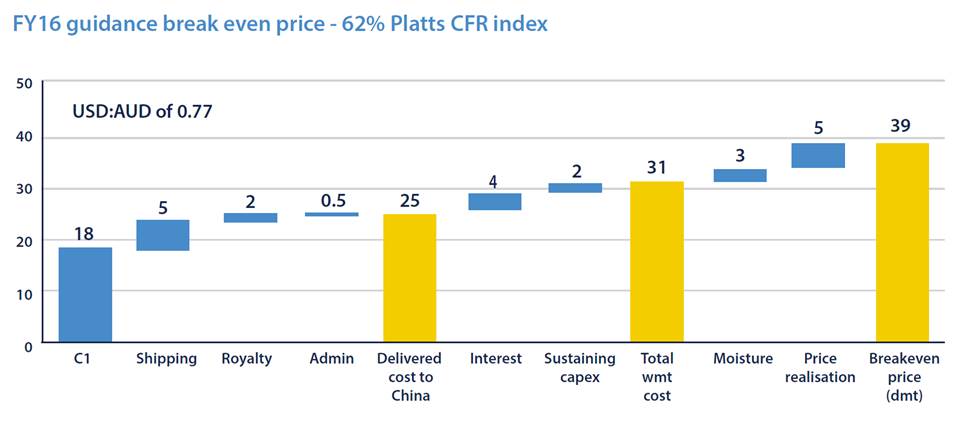

FY16 guidance for improved cost performance

- Preliminary FY16 shipping guidance is estimated at 165mtpa with C1 cost guidance of US$18/wmt, based on a cost of production exit rate of USD20/wmt in FY15

- Sustaining capital expenditure, excluding exploration expenditure, is estimated to be USD330 million in FY16 or USD2/wmt

- USD18/wmt C1 costs would result in total delivered costs to China of USD25/wmt in FY16, and an all-in cash cost of around USD31/wmt

- Based on this guidance, Fortescue’s breakeven index price in FY16 would be USD39/dmt. This is reflected in the chart below

Source: Fortescue Metals Group

We note that, while the cost guidance for FY16 looks substantially improved, there remains scepticism from the market as to whether this cost guidance is sustainable beyond FY16.

Cash flow forecasts

Below we provide two forecasts of Fortescue’s cash position, based on two sets of iron ore price forecasts. The analysis below highlights the sensitivity of Fortescue’s earnings to small movements in the iron ore price. At a USD35/tonne iron ore price, the company would completely exhaust its cash balance by end FY16 if it does not roll over prepayments, which would place liquidity pressures on the company. However, if S&P’s revised iron ore price assumptions play out (second scenario below), the cash balance would be USD2.0bn at end FY16.

Please note that we have also factored in the amortisation of prepayments as an additional cost item, on the conservative assumption they won’t be rolled over. Prepayments are like a form of short-term borrowing for the company, where it negotiates an upfront payment from its customers in exchange for the delivery of future tonnes. Fortescue notes that it has received significant interest from potential and existing customers who are interested in entering into new prepayment contracts or rolling over existing prepayments. If prepayments are rolled over the cash forecasts below would improve.

- At USD35/dmt, which has been the quoted assumption being mulled by the Federal Treasurer and some analysts, the cash burn rate would look as follows.

- June quarter (assuming breakeven price of USD42): -USD240m cash burn - USD150m prepayment amortisation = (USD390m)

- FY16: -USD544m cash burn - USD850 prepayment amortisation = (USD1,394m)

Therefore, at the USD35/dmt assumption, the cash balance of USD1.8bn would likely be fully eroded by the end of FY16, if prepayments are not rolled over and cost guidance is achieved (and no dividends are paid), which would place liquidity pressure on the company.

- At USD45/dmt, which is S&P’s assumed iron ore price for 2015 increasing to USD50/dmt in 2016, Fortescue would be net cash flow positive through FY16 assuming prepayments are not rolled over. The cash position would be expected to move as follows

- June quarter: +$102m cash flow – $150m prepayment amortisation = -$48m

- FY16: +$1,156m cash flow – $850m prepayment amortisation = +$306m

Therefore, at S&P’s revised iron ore price assumptions, the cash balance of USD1.8bn would increase to about USD2.0bn by the end of FY16, if prepayments are not rolled over and cost guidance is achieved (and no dividends are paid)

Debt maturity profile

The chart below is a reminder of the current debt position of Fortescue, and goes some way to explaining why the 2019 and 2022 senior unsecured bonds experience significant falls when iron ore prices move down.

The company has USD4.9bn of senior secured debt maturing in 2019, and we understand from media reports that this debt has no maintenance covenants. The 2017’s and 2018’s have traded around par levels on the expectation that the cash balance is sufficient to pay out these bonds, which remains valid if iron ore prices remain at USD50/dmt levels and the company delivers on its cost guidance. From 2019 onwards, the market has discounted the value of the 2019 and 2022 bonds given they rank below senior secured debt in a default scenario, as well as the potential risk of lower iron ore prices over the long term, eroding the company’s ability to pay its longer term debts.

Source: Fortescue Metals Group