Coffey International gave a first quarter FY16 update as part of its AGM held this morning

We also note the company has announced a takeover offer. This is a very credit positive development and full details are discussed in a separate article which can be found here.

In terms of 1Q16, revenue by division was as follows:

- Geoservices: Fee revenue of $38m was down compared the prior corresponding period of $53m.The order book is starting to strengthen

- Project Management: Continued to operate profitably with total revenue of $6m compared to $7m the prior period with an improved and lengthening order book

- International Development: Total revenue rose to $82m 1Q16 from $74m the corresponding period with total contracted work at record levels at $668m

The company is now mostly focused on less volatile International Development and Infrastructure sectors. Any exposure to the more volatile mining, oil or gas sectors is mainly to mature operating facilities and via remediation work.

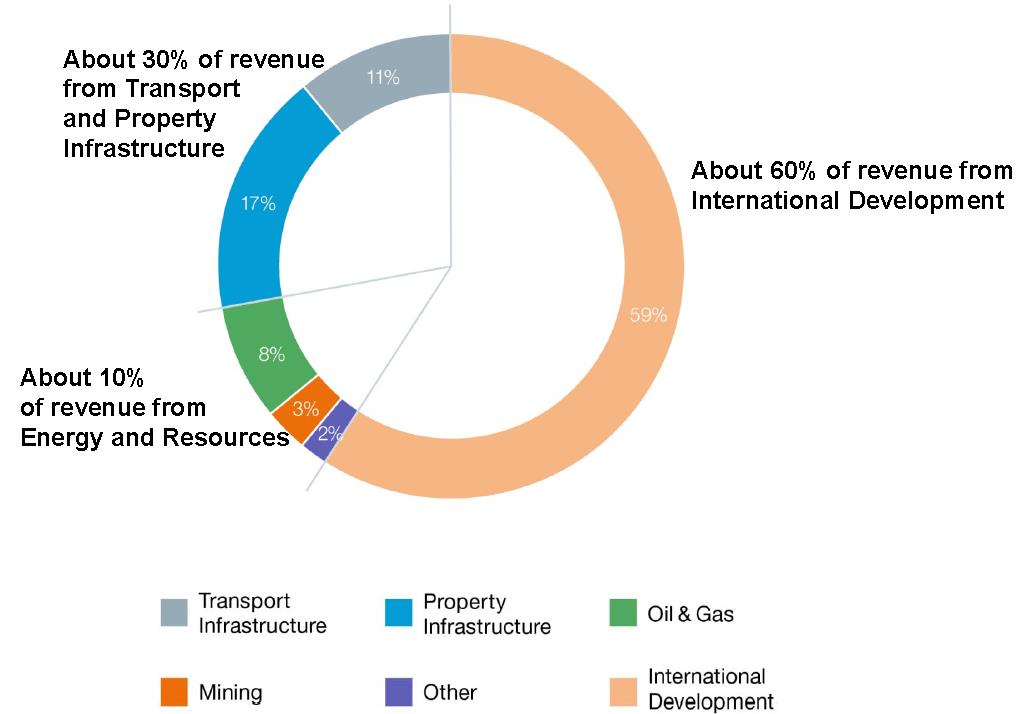

Revenue by industry 1Q16

Source: Company report

International Development (stable government contracting) now accounts for roughly 60% of total revenue with another ~30% from infrastructure, in both property and transport. Only about 10% of revenue came from mining, oil and gas.

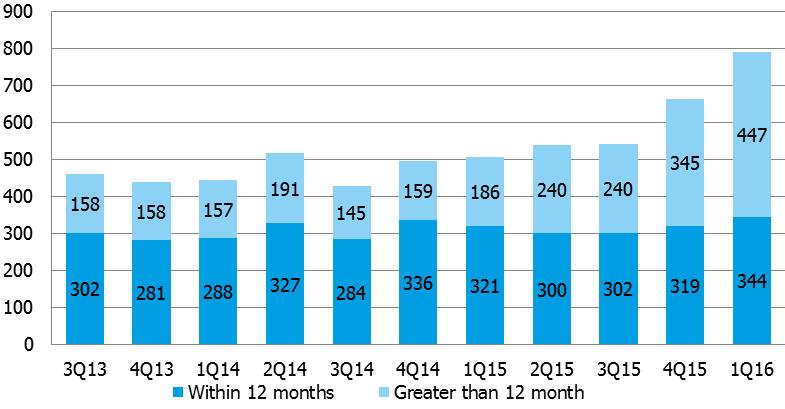

Debt profile

Source: Company report

Net debt increased to $68m from $65m in September 2014. This was impacted by restructuring costs as well as the falling AUD. A total of $33m of debt is in USD via Coffey’s US subsidiary. Therefore when translated into AUD for reporting purposes the FX translation added nearly $9m to debt. While the depreciating Australian dollar does impact the balance sheet, it also improves the company’s international competitiveness.

Outlook

Coffey did not give FY16 guidance however forward contracted fee revenue by division was provided. Positively, overall contracted fee revenue continues to increase notably. This has been driven by the International Development sector which posted record contracts.

Contracted fee revenue (m)

Source: FIIG Securities, company report