Stockwell has provided a trading update for the nine months to March 2016

Trading update: 9 months ending 31 March 2016.

| $m | Actual | Budget | Difference |

| Rental income | 3.40 | 3.50 | -0.10 |

| Development management | 4.47 | 4.46 | 0.01 |

| Property, leasing & funds management | 2.10 | 2.89 | -0.79 |

| Management fees | 0.14 | 0.16 | -0.02 |

| Development income | 1.78 | 1.50 | 0.28 |

| Other | 2.34 | 2.37 | -0.03 |

| Total revenue | 14.22 | 14.87 | -0.65 |

| | | | |

| Development costs | 2.14 | 2.20 | -0.05 |

| Project contractors | 1.07 | 0.90 | 0.17 |

| Property expenses | 2.32 | 2.71 | -0.39 |

| Lease expenses | 0.60 | 0.57 | 0.04 |

| Employee costs | 3.17 | 3.23 | -0.06 |

| Other | 1.41 | 1.41 | 0.00 |

| Total expenses | 10.71

| 11.01 | -0.30 |

| | | | |

| EBITDA | 3.51 | 3.86 | -0.35 |

| Depn & amort | 1.25 | 1.22 | 0.03 |

| EBIT | 2.26 | 2.64 | -0.38 |

| Net interest | 1.76 | 1.88 | -0.12 |

| Profit before tax | 0.50 | 0.76 | -0.26 |

| Extraordinary items | 3.57 | 2.25 | 1.32 |

| Tax | 0.09 | 0.00 | 0.09 |

| Net profit after tax | -3.16 | -1.49 | -1.67 |

| | | | |

| Operating income/revenue | 40% | 44% | |

| EBITDA interest | 2.00x | 2.06x | |

| Debt/tangible assets* | 51.6% | | |

*As defined in the IM

Source: Stockwell

Revenue for the nine months to 31 March was slightly lower, driven by fewer leasing deals than expected. This however was offset by lower expenses relating to that leasing. Development income was higher than budgeted due to the sale of land at Northern Beaches Central.

Extraordinary items are $1.32m above budget due to the previously highlighted interest rate break costs associated with entering into more favourable financing rates relating to the Retail Portfolio.

Gearing, debt/tangible assets as defined in the IM, of 51.6% remains well below the covenants of 75%.

Stockwell’s Residential Management division is preparing for the rental campaign in relation to the 151 apartments at Habitat in July as well as the 70 apartments at Boggo Road Stage 1 from September. This will provide further income growth going forward.

Property investments

The Property Investments division currently has interests in three neighbourhood shopping centres in Queensland. The security of the Notes includes WAS’ equity interests in each of the centres. Operating cashflows from these investments provide more than sufficient coverage on the interest component of the Notes.

Bargara Central, near Bundaberg: Stockwell has signed leases with Woolworths to expand to 3,800m2 and Aldi to occupy the remainder of the vacant supermarket area. This follows approval for an expansion and refurbishment of the supermarket tenancies. Construction has commenced with ADCO the appointed builder. The expansion is anticipated to open early December 2016. Stockwell estimates an uplift in value from ~$30m to ~$38m.

This quarter also saw a physio and chiropractor open in the commercial tenancies and existing tenant Y Fitness expanded by 100m2.

Stones Corner Village, Brisbane: In line with the last update focus has been on internal leasing. Stockwell has signed a new lease with a bakery which is set to open this month.

Northern Beaches Central, Mackay: Stockwell continues to canvas for the vacant spaces at this centre. Given the centre’s low exposures to discretionary retailers, it is expected to be less impacted by the economic slowdown in the region.

Residential development projects

There has been continual commentary regarding the possibility of inner city unit oversupply. Further, financial institutions have been tightening their lending policies. Given these developments a more in depth analysis of Stockwell’s residential developments is given below.

By way of background, banks have been tightening lending standards for investment lending and especially for inner city unit developments. Further most lenders have also stopped lending to overseas buyers. The move follows the discovery by multiple banks of hundreds of fraudulent home loans backed by fraudulent income documents.

We also note the potential oversupply in inner city apartments in various capital cities including Brisbane where Stockwell’s developments are focused. In Brisbane, 15,900 apartments are currently under construction and are expected to complete in 2016 to 2020. An additional 5,100 are currently being actively marketed for completion over the same period. Approximately 33% of these are located in the south Brisbane/West End region. Stockwell has multiple developments in West End.

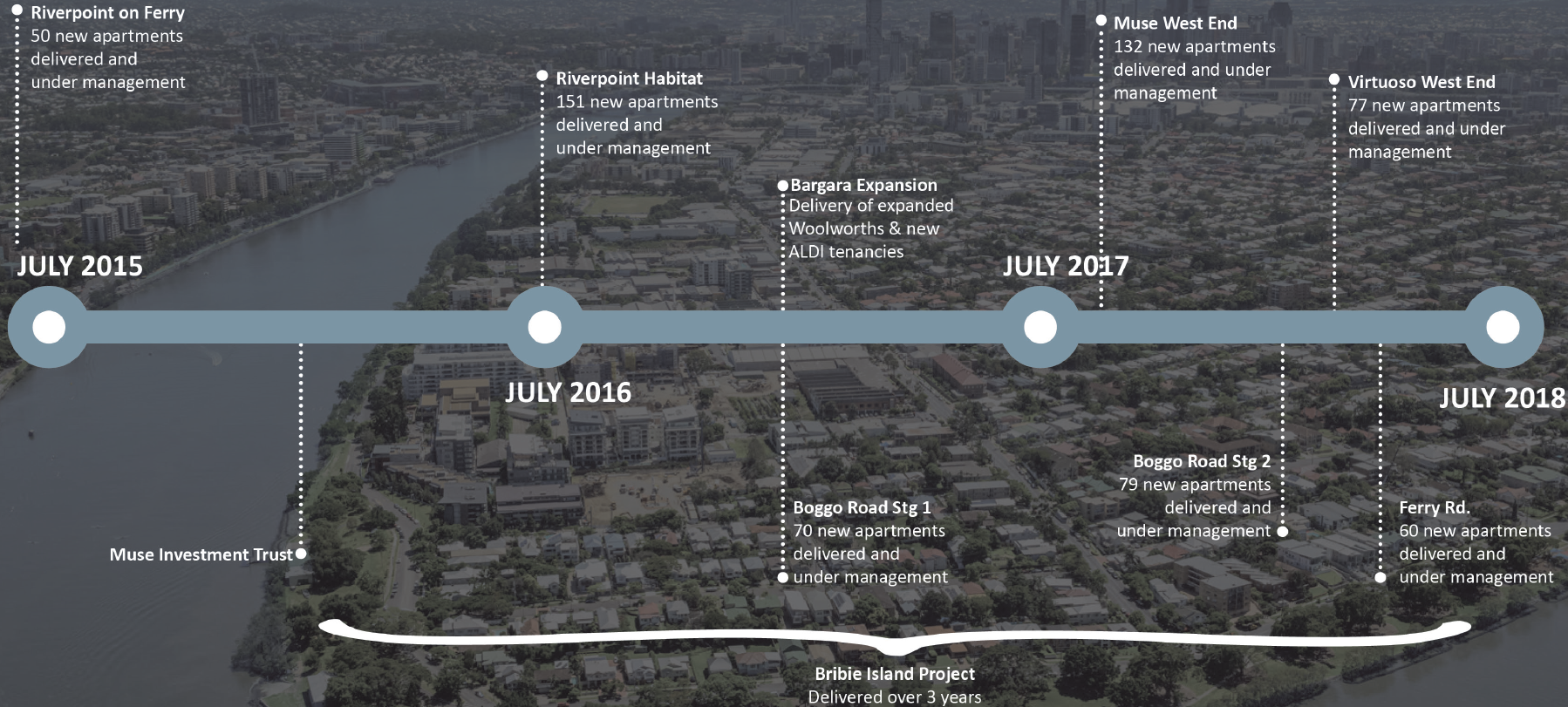

A timeline of Stockwell’s developments is given below as well as table summarising key aspects of each project. Following this we discuss each project’s potential risks and strengths.

Source: Stockwell

Source: Stockwell

| | Units | Sold | Settlement | Gross value ($m) | Net value ($m) |

| Habitat Riverpoint, 43 Forbes St | 151 | 100% | Aug-16 | $66.8 | $5.9 |

| Boggo Road, Stage 1 | 70 | 100% | Oct-16 | $33.0 | $6.3 |

| Muse, 399 Montague Rd | 132 | 75% | Sep-17 | $58.8 | $13.3 |

| Boggo Road, Stage 2 | 79 | 61% | Nov-17 | $37.8 | $7.0 |

| Virtuoso, 51 Ferry Rd | 77 | 40% | Apr-18 | $107.4 | $14.8 |

| Ferry Road, 50 Ferry Rd | 60 | 12% | Apr-18 | $41.0 | $6.8 |

| Bribie Island | 159 | Pre DA | over 3 years | $74.5 | $20.6 |

Notes:

1. Gross value is "on completion"

2. Net value is actual or expected WAS equity share

Habitat Riverpoint, 43 Forbes St, West End: Given this is fully sold and settling from next month, this represents minimal risk. The company has no indication of settlement issues with any buyers including those from overseas, which only amount to 18 out of 151 buyers. Further there has been no price depreciation which reduces valuation risks and therefore settlement risk.

Boggo Road, Dutton Park: This project is outside the inner city, in an area not affected by potential oversupply. However it is still only 4kms from the CBD, and has access to excellent transport and infrastructure. The development has proven popular with local Brisbane investors, more familiar with the area, representing over half of the sold out 70 unit stage one. Stage one settles in September and therefore represents minimal risks.

Muse, 399 Montague Rd, West End: This is considered the highest risk of Stockwell’s developments. It is a medium size 132 unit development across two towers of mostly more commoditised investor stock. It is also forecast to settle at the height of inner city unit supply in September 2017. Further approximately 25% of this development is forecast to be sold to Chinese buyers. Stockwell has an experienced specialist settlement team that focus on the settlement process including a strong working relationship with the agents and the buyers ensuring early indentification and support to ensure buyers are settlement ready.

Virtuoso, 51 Ferry Rd, West End: The development is intended for owner occupiers. There are 77 three to five bedroom apartments in this prime riverfront development featuring ‘front to back’ floor plans. They are priced at $1.3m to $2.2m. This part of the market is distinct from investor stock where oversupply is a risk. Launched in June 2015 and due for completion in April 2018 sales are in line with expectations with 40% sold.

Ferry Road, 50 Ferry Rd, West End: Again this development is intended predominantly for owner occupiers, with limited investor stock. The units are priced from $600k to $995k and have larger floor plans and higher end fittings than traditional investor stock.

Bribie Island: This project adds diversity to Stockwell’s pipeline. It is outside the Brisbane property market and also in a different sector of gated retirement lifestyle living. 159 lots are planned. Stockwell will supply community facilities (including swimming pool, bowling green, BBQ area and tennis courts) and manufactured homes. Stockwell will rent the land to the owner which will provide an ongoing income stream for the group.

Relative value

The trading margins of AUD high yield property companies are highlighted below.

Compared to Stockwell (WAS), Sunland has a better credit profile with a stronger balance sheet, and greater financial flexibility. Noting the higher spread and earlier maturity, we view Sunland as offering better relative value.