Key points

- Strong 1H14 results: 59% increase in revenue, 72% increase in EBITDA versus 1H13

- Opportunity to diversify into the growing Australian childcare sector

- Australia’s largest publicly listed operator of childcare centres

- Offers a high 6.06%p.a yield to maturity

G8 has reported a strong operating result for the half year ended 30 June 2014. Compared to the prior corresponding half year period, revenues have increased by 59% to $187.2m, EBITDA has increased by 72% to $32.4m and net profit after tax has increased by 48% to $16.3m. The positive performance reflects G8’s successful strategy of progressively acquiring childcare centres in Australia and increasing market share.

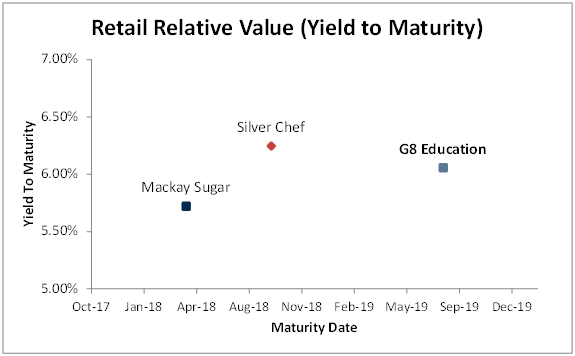

Last week the G8 Education Limited fixed rate bonds maturing in August 2019 became available to retail investors. Currently, this bond offers a high annual income (running yield) of 7.17%p.a. and a yield if held to maturity of 6.06%p.a. The yield to maturity is less than the running yield because the bond is currently trading above its redemption value so investors who buy now and hold to maturity will receive slightly less at maturity than they pay for the bond.

Despite this, because of its high annual income the G8’s yield to maturity is high, comparable to the Mackay Sugar and Silver Chef high yield issuances.

Given the outright return opportunity available, the G8 Education fixed rate bonds provide retail investors with a valuable diversification opportunity now that it has become available.

Through a strategy of disciplined acquisition and consolidation, G8 Education has grown to become the largest publicly listed owner and operator child care centres in Australia, while maintaining a sound credit profile.

Further details of our view on the G8 credit are available in the FIIG research report on the FIIG website.

Please speak to your FIIG representative if you are interested in any of these bonds.

All prices and yields are a guide only and subject to market availability. FIIG does not make a market in these securities.