Continuing our series that explores the Benefits of being a Wholesale Client, our next edition highlights the role US dollar bonds can play in diversified portfolios. In previous articles, we looked at credit ratings (here), FIIG-arranged unrated primary issues (here), and public market primary deals (here).

Many investors are perhaps familiar with the New York Stock Exchange or the NASDAQ, but in fact the US bond market is the largest and most liquid securities market in the world.

As a proportion of total Wholesale investments in our custody, over 15% are allocated towards USD bonds with that percentage much higher when we exclude clients having no USD exposure at all.

Diversification

While Australia’s bond market – and more specifically, our high yield bond market – is underdeveloped, gaining access to a wider range of bonds through the US market is very beneficial for diversification. Similar to local bonds, these are able to be purchased in $10,000 minimum parcels (unless stipulated otherwise by the issuer) and offer investors the ability to diversify their portfolio allocations through a greater number of issuers and opportunities available for investment.

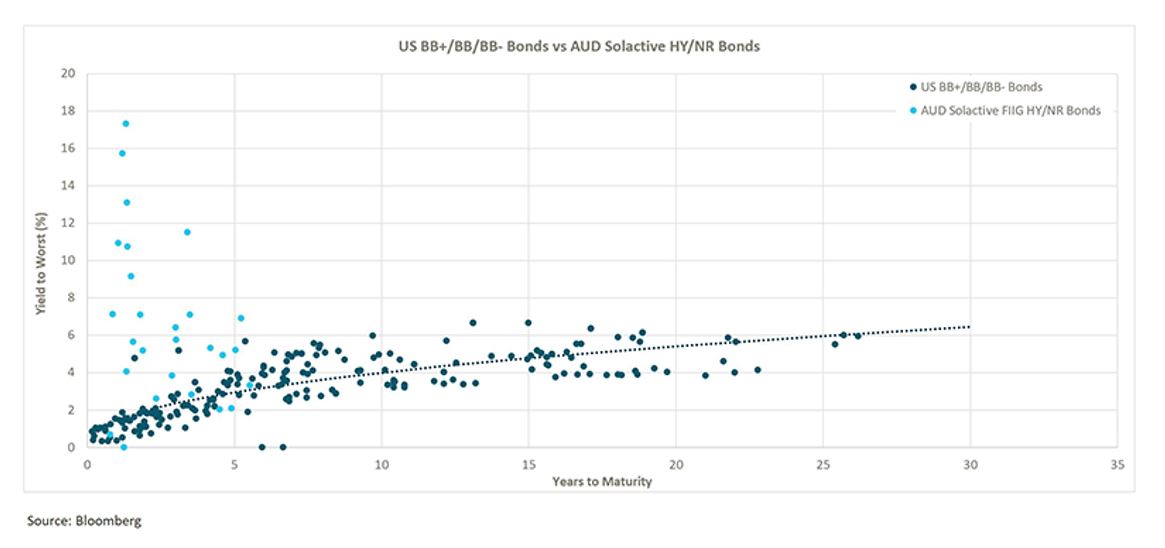

The chart below compares the USD BB universe to the AUD High Yield index. It is clear that the sheer number of bonds available in USD compared to the relatively small number in AUD allows high yield investors, in particular, a much greater choice of risk and reward options:

Liquidity

To access liquidity when trading with external institutional counterparties, the requirement to trade is a parcel size of $500,000 face value. We can break these parcels down via our DirectBond process for individual investors, but we need a collective effort to be able to trade with the rest of the market in the minimum face value size required.

While this provides an additional layer of liquidity for investors outside of our large internal liquidity pool, building to the size required to execute can take some time.

This limitation, however, doesn’t tend to exist in the much deeper and more liquid USD market, as we are often able to buy and sell bonds in the overnight time zone with foreign institutions and banks in $100,000-$200,000 sizes.

This is not only a liquidity benefit in being able to transact more frequently with the US bond market, but we are also able to transact in these smaller parcels through USD bonds in our time zone – as we trade the majority of our Australian credits that have issued USD-denominated bonds with Asian counterparties*.

Companies Issuing USD Bonds Only

When investors are exposed to a new asset class and have complete control over the investments in their portfolio, name recognition is one of the key factors for investor’s consideration. When looking for foreign currency exposure and the yields that this market offers, investors tend to find comfort in recognising Australian companies who have chosen to issue USD-denominated bonds to meet their funding requirements rather than US-domiciled issuers they are unfamiliar with.

Fortescue Metals, BHP and Newcastle Coal are all very well-known local names who regularly issue USD-denominated bonds. The crucial commodity-centric issuers mentioned above are fundamental to Australian GDP but tend to have their financial obligations in USD.

Due to these funding requirements, all three companies only issue USD-denominated bonds rather than tapping the AUD bond market. These issuers focus on issuance in USD as a natural currency hedge, given their revenue is predominantly in USD. Being a Wholesale investor gives access to the US bond market but also to a larger number of opportunities in Australian companies, which investors would otherwise not be able to gain exposure to.

Credit Ratings on USD Bonds

As highlighted in our #2 edition of this series, Wholesale clients are able to gain access to FIIG-originated transactions. It was highlighted in this piece that these higher yielding transactions are unrated, as the companies looking to issue debt are often smaller in nature.

Comparatively, with the US bond market being a much larger and deeper market, the rating agencies rate every issuer and issue – which is particularly relevant for sub-investment grade bonds.

Whereas the Australian market primarily consists of either government/semi-government, investment grade or non-rated corporate credits, through USD bonds, we also gain access to several positions that sit within the BB-rated basket (BB+, BB and BB-) as well as those assigned a single B rated basket (B+, B and B-). This is helpful as we consider higher yielding opportunities for investors comfortable in gauging the level of risk they are comfortable taking to achieve their return objectives.

It is important to note that we do not enable investors to purchase bonds that have a credit rating of CCC+/Caa1 or lower. When a bond is downgraded from B- to CCC+ or below, this means that the issuer is highly reliant on favourable conditions to remain solvent in a 12-to-18-month time horizon. This heightened uncertainty means we believe the risk is too great, and therefore we do not offer these as the risk lies outside of our parameters.

Currency Risk

Clearly, introducing USD-denominated bonds into an AUD-based currency portfolio brings with it foreign currency risk.

In certain environments, such as when the AUDUSD rate was trading above parity, this exposure is desired as it can lead to excess gains over and above those earned from the bond investment alone. Of course, this can go the other way if the exchange rate moves against the investor.

Our belief is that the diversification and liquidity benefits offered by the USD market outweigh the additional foreign currency risk introduced.

The best way to mitigate this risk outside of direct hedging is to maintain a semi-permanent allocation to USD bonds and manage the portfolio within the separate currency. Those features of depth and liquidity allow for this to be done in smaller parcels which further enhances the attractiveness of USD-denominated bonds.

At some point in the future, when the currency is to an AUD investor’s advantage, then the USD allocation can be closed at an appropriate rate, but until then, rotation within the currency allocation is generally the preferred method.

*it is important for investors to be aware that, should you wish to purchase US domiciled bonds, you will not only require a Wholesale certificate but also a valid W-8BEN/W-8BEN-E form applied to your account which relates to tax withholding. Should you wish to seek further information on this, we would encourage you to speak with your accountant.